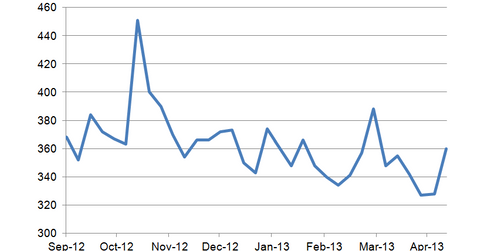

Initial jobless claims jump

Initial jobless claims rose to an annualized rate of 360,000 for the week ended May 10th Initial jobless claims are one of the few labor market indicators that are released every week. Unemployment is a profound driver of economic growth, and persistent unemployment has been the Achille’s heel of this recovery. While it seems like […]

Dec. 4 2020, Updated 10:53 a.m. ET

Initial jobless claims rose to an annualized rate of 360,000 for the week ended May 10th

Initial jobless claims are one of the few labor market indicators that are released every week. Unemployment is a profound driver of economic growth, and persistent unemployment has been the Achille’s heel of this recovery. While it seems like the big layoffs are largely finished, firms are still reluctant to add staff aggressively. Aside from the Hurricane Sandy influenced spike in late October, initial jobless claims have been holding steady in the 340,000-380,000 range.

Historically, real estate prices have tracked very closely with incomes. In fact, up until the real estate bubble burst, the ratio of median home price to median income remained in a relatively tight range of 3.2x-3.6x. So if unemployment is rising, there is little upward pressure on wages, which tends to be a negative for home prices. Plus, the unemployed are unable to qualify for a mortgage, so the pool of buyers shrinks.

Initial jobless claims are back to pre-bust normalcy

Before the housing bust, initial jobless claims averaged around 356,000 from 1990 to 2007. It is not indicative of a healthy economy, where claims are below 300,000. Given that some of the economic indicators are starting to turn downward, they may rise again.

As the sequestration cuts start to hit, this indicator will probably become a political issue. Government contractors have already started furloughs, where workers will take one day off per week. The Congressional Budget Office has forecast that the sequestration cuts will reduce GDP by 0.6% for FY 2013. If we see initial jobless claims tracking back above the 400,000 level, we will undoubtedly start seeing political pressure for both Republicans and Democrats to find a way to keep government employees and contractors on the job.

The initial budget proposal by the President envisions restoring the spending cuts from the sequester and additional stimulus. This probably will not happen unless the employment picture changes markedly. So far, as we have seen from today’s Challenger and Gray job cut announcements, there have not been many layoffs due to the sequester. Today’s report had the number below 2,000 for the aerospace/defense industry.

Impact on mortgage REITs

Non-agency mortgage REITs, such as Chimera (CIM), PennyMac (PMT) or Two Harbors (TWO), which invest in non-government guaranteed mortgage backed securities, are sensitive to the economy as defaults can influence returns. The unemployment rate is by far the biggest driver of defaults. Agency REITs, such as MFA Financial (MFA) or American General (AGNC), that invest in Ginnie Mae (government guaranteed) or conforming (Fannie Mae – government sponsored), consider defaults to be just a different type of prepayment. It is typically the higher coupon loans that have default issues, and once the loans become 90 days delinquent, they are typically purchased out of the pool by the lender and repaid at par. This has the effect of lowering returns for the portfolio going forward.