Chimera Investment Corp

Latest Chimera Investment Corp News and Updates

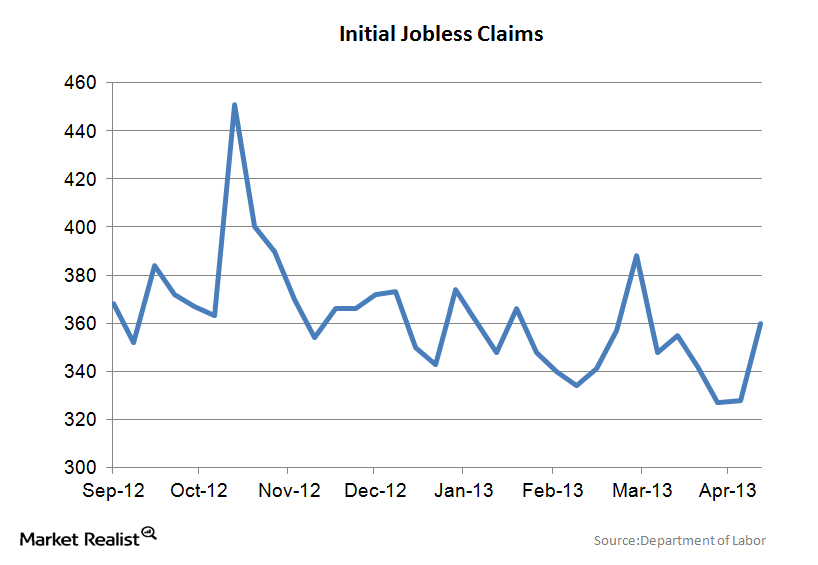

Initial jobless claims jump

Initial jobless claims rose to an annualized rate of 360,000 for the week ended May 10th Initial jobless claims are one of the few labor market indicators that are released every week. Unemployment is a profound driver of economic growth, and persistent unemployment has been the Achille’s heel of this recovery. While it seems like […]

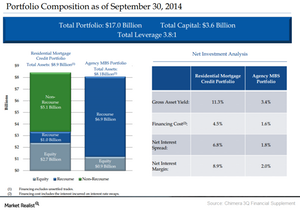

Chimera posts growth in third quarter profit and interest income

Chimera’s core earnings grew to $116 million compared to $93 million in the year-ago period. Growth was mainly due to an increase in net interest income.

What Are Leon Cooperman’s Top Holdings?

In Q3 2020, billionaire investor Leon Cooperman’s top five holdings were Fiserv, Mr. Cooper Group, Alphabet, Cigna, and Trinity Industries.