Why India’s Services PMI Rose in October

According to data provided by Markit Economics, the final Markit services PMI (purchasing managers’ index) for India strengthened in October 2017.

Nov. 22 2017, Updated 1:30 p.m. ET

India’s services PMI in October

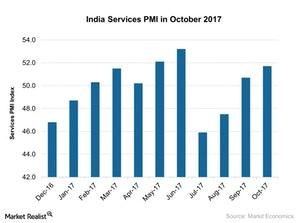

According to data provided by Markit Economics, the final Markit services PMI (purchasing managers’ index) for India strengthened in October 2017. It stood at 51.7 in October 2017 compared to 50.7 in September 2017 and beat the preliminary market estimate of 51.5.

The services PMI was affected by the following factors:

- Production output showed strong improvement in October 2017 as compared to September.

- New business orders also improved at a higher rate in October 2017 as compared to September.

- The employment in the service sector also rose for the second consecutive month in October 2017.

The improved performance of the service sector is indicating that India’s service industry benefited from the GST implementation. The stronger export order in October also boosted the performance of the service industry during the month.

Performance of various ETFs in October

The Nifty 50 Index rose 5.5% in October 2017. The iShares MSCI India (INDA), which tracks the performance of India, also showed a strong performance in that month. It rose nearly 7.2% in October 2017, while the Vanguard FTSE Europe ETF (VGK), which tracks Europe’s (HEDJ) (EZU) (IEV) economic performance, rose 0.5% in October 2017.

In the next part of this series, we’ll analyze the performance of Brazil’s manufacturing PMI in October 2017.