Interest Rate Expectations Have Jolted Equity and Debt Alike

Asset managers (VFH) are seeking stability in order to attract funds toward either equity or debt offerings.

Dec. 4 2020, Updated 10:52 a.m. ET

Monetary policy

The US stock market rout and withdrawals from debt funds in recent weeks have been the aftereffects of the indication of faster rate hikes by the Federal Reserve in its meeting in February 2018. The pace of withdrawals from equities and debt funds has led to a sudden change in investor confidence.

Due to the implementation of lower tax rates, the fiscal deficit is expected to rise, resulting in a fall in the US dollar. The probability of the Fed’s targeting four rate hikes this year has decreased, which could result in some pause or consolidation in the broader markets.

Seeking stability

Asset managers (VFH) are seeking stability in order to attract funds toward either equity or debt offerings in active and passive products. Managers with global offerings in Europe, Japan, and Asia are seeing more traction as investors are seeking returns out of the United States. BlackRock (BLK), with its diversified product offering and ETFs allowing for investments in global equities, is preferred by institutional as well as retail investors.

Debt versus equity

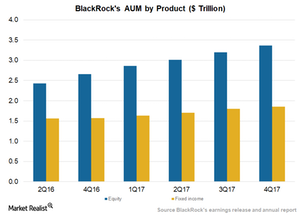

BlackRock is managing ~$1.9 trillion in fixed income offerings as of December 31, 2017, up from $1.6 trillion in the prior year. This number could fall or remain stable in 1Q18 and rise in 2018. It manages $3.4 trillion in equities, which are expected to see the biggest effects of the recent stock decline.

Banks and asset managers, including T. Rowe Price (TROW), State Street (STT), and Wells Fargo (WFC), tend to lose more in the era of capital flight. However, the trend is expected to be short term until the dollar and interest rate policy stabilize.