Does Vale Deserve a Rerating of Its Valuation Multiple?

Vale’s CFO (chief financial officer) Luciano Siani Pires said during Vale Day on December 6, 2017, that the company deserves a rerating of its valuation.

Dec. 14 2017, Updated 12:28 p.m. ET

Valuation multiple rerating?

Vale’s CFO (chief financial officer) Luciano Siani Pires said during Vale Day on December 6, 2017, that the company deserves a rerating of its valuation for the reasons below.

- A year ago, there were a lot of uncertainties for the company, including the expiration of the shareholder agreement, concerns over the company becoming state-owned, and a change in its CEO (chief executive officer). They resulted in a lower multiple for the company. Pires said that since the circumstances are completely different now from a governance perspective, the stock needs to be rerated.

- Pires said the company will become very predictable, which “will deliver and run like a clock.” Its capital expenditure will continue to decline, he said, and the uncertainties will be over. More predictability, he believes, deserves a higher multiple.

Relative valuation

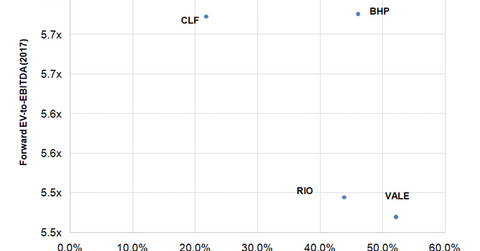

Currently, Vale (VALE) has a forward EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiple of 5.4x, which is a discount of 24% to its past five-year average multiple.

Diversified miners (GNR) Rio Tinto (RIO) and BHP Billiton (BHP) are trading at similar multiples of 5.5x and 5.7x, respectively.

Cleveland-Cliffs (CLF) is trading at a forward multiple of 5.7x. However, it’s not directly comparable to these miners due to the smaller seaborne iron ore footprint and the nature of contracts and products.

Valuation catalysts

As we’ve seen in the previous parts of this series, Vale’s S11D project is proceeding as scheduled. The project has the potential to reduce its iron ore unit costs below $10, along with a significant increase in volumes. These factors could help Vale stock going forward.