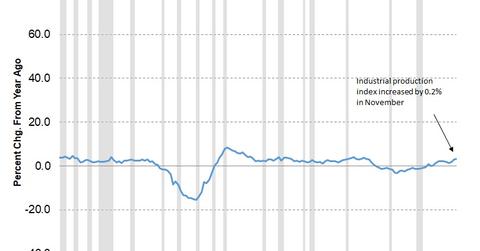

Why Industrial Production Fell from 1.2% to 0.2% in November

The Federal Reserve released its November industrial production report on December 15, 2017. The report indicated that industrial production improved 0.2% in November.

Dec. 22 2017, Published 2:05 p.m. ET

November industrial production rose 0.2%

The Federal Reserve released its November industrial production report on December 15, 2017. The latest report indicated that industrial production improved 0.2% in November, which was well below the upward revised October increase of 1.2%. The index posted an impressive year-over-year growth of 3.4%, the fastest annual increase since 2014.

The industrial production index tracks the performance of manufacturing (XLI), gas and utilities (XLU), mining (XME), and electricity. Changes to the index can be used as a forward indicator of demand from industry. The equity markets (SPY) respond positively to continued improvement in industrial production.

November fall is a return to normalcy

This is the third consecutive month of gains for the industrial production index after the August slump. According to the Federal Reserve’s statement, industrial production would have been flat in November if the post-hurricane rise in the oil and gas extraction industry was excluded. If that were the case, the annual growth rate of 3.4% would show that the sector is on strong footing and continuing to expand. The recently approved tax reform bill may not have an immediate impact on industrial production, but in the long run, we can probably expect some benefit to the industry.

Which sectors improved in November?

In November, the mining sector (PICK) improved the most by 2%, while manufacturing rose 0.2%. The utilities sector fell 1.9%. For the entire year, manufacturing has risen 2.6%, while industrial production in the auto industry has risen 0.1%.

In the next part of this series, we’ll analyze the changes in capacity utilization at US industries in November.