Goldman Sachs Upgrades Philip Morris International to ‘Conviction Buy’

Price movement Philip Morris International (PM) has a market cap of $162.2 billion. It rose 3.2% to close at $100.64 per share on September 12, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -1.1%, 1.8%, and 16.9%, respectively, on the same day. PM is trading 0.49% above its 20-day moving average, […]

Sept. 14 2016, Updated 9:56 a.m. ET

Price movement

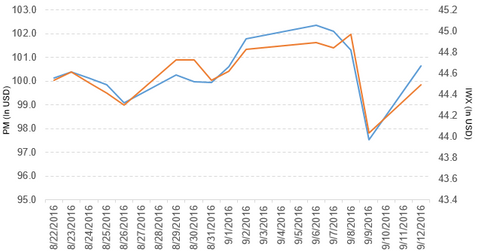

Philip Morris International (PM) has a market cap of $162.2 billion. It rose 3.2% to close at $100.64 per share on September 12, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -1.1%, 1.8%, and 16.9%, respectively, on the same day.

PM is trading 0.49% above its 20-day moving average, 0.22% above its 50-day moving average, and 6.2% above its 200-day moving average.

Related ETF and peers

The iShares Russell Top 200 Value ETF (IWX) invests 0.99% of its holdings in Philip Morris. The ETF tracks an index of US large-cap value stocks. The index selects from stocks ranked 1–200 by market cap based on two style factors. The YTD price movement of IWX was 6.6% on September 12.

The market caps of Philip Morris’s competitors are as follows:

Philip Morris’s rating

Goldman Sachs has upgraded Philip Morris International’s rating from “neutral” to “conviction buy.” It also raised the stock price target to $114.00 from $106.00 per share.

Performance of Philip Morris in 2Q16

Philip Morris (PM) reported 2Q16 net revenues of $19.0 billion, a rise of 1.1% compared to net revenues of $18.8 billion in 2Q15. Net revenues, which exclude excise taxes from the European Union, rose 4.6%.

Net revenues from EEMA (Eastern Europe, Middle East, and Africa region), Asia, and Latin America and Canada fell 9.9%, 0.6%, and 13.6%, respectively, in 2Q16 compared to 2Q15. PM’s cigarette shipment volume in the European Union, EEMA, Asia, and Latin America and Canada fell 0.8%, 4.0%, 7.9%, and 5.9%, respectively, in 2Q16 compared to 2Q15.

The company’s gross profit margin and operating income fell 5.8% and 4.8%, respectively, in 2Q16 compared to 2Q15. Its net income and EPS (earnings per share) fell to $1.8 billion and $1.15, respectively, in 2Q16 compared to $1.9 billion and $1.21, respectively, in 2Q15.

PM’s cash and cash equivalents rose 11.6% in 2Q16 compared to 4Q15. The company reported free cash flow excluding currency of $2.7 billion in 2Q16, a fall of 22.9% compared to 2Q15.

Philip Morris (PM) projects EPS in the range of $4.45–$4.55, which does not include any share repurchases in 2016. This projection also excludes the impact of any future acquisitions, future changes in currency exchange rates, unanticipated asset impairment and exit cost charges, and any unusual events.

Next, we’ll discuss Reynolds American (RAI).