How Is Gold, Commercial and Non-Commercial, Moving?

Speculative positions fell sharply last week. It was the most significant one-week fall since May 2016.

Dec. 12 2017, Published 9:49 a.m. ET

Gold positions

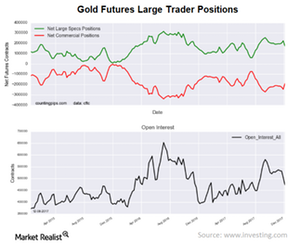

It’s important for precious metal investors to look at the positions of large traders. Many of the price movements in the top two precious metals—gold and silver—are dependent on what the expectations for them are.

According to the Commodity Futures Trading Commission data as of Friday, December 8, 2017, large speculators substantially cut their positions in gold futures last week.

The non-commercial futures contracts, which are traded by large speculators and hedge funds, totaled a net position of 173,329 contracts as of Tuesday, December 5. It was a weekly fall of 51,088 contracts compared to the previous week’s 224,417 net contracts.

Speculative positions fell sharply last week. It was the most significant one-week fall since May 2016. Commercial traders saw a weekly gain of 56,651 contracts from the net total of -246,541 contracts reported the previous week.

Funds and miners

Precious metal–based funds, including the PowerShares DB Gold ETF (DGL) and the Merk Gold ETF (OUNZ), have fallen over the past month. DGL and OUNZ fell 2.3% and 2%, respectively, on a 30-day trailing basis. Most of the mining stocks have also fallen in the past month. Barrick Gold (ABX), Kinross Gold (KGC), Eldorado Gold (EGO), and Harmony Gold (HMY) fell 2.4%, 7.2%, 4.1%, and 5%, respectively, on a 30-day trailing basis.