What Analysts Estimate for Priceline in 4Q17

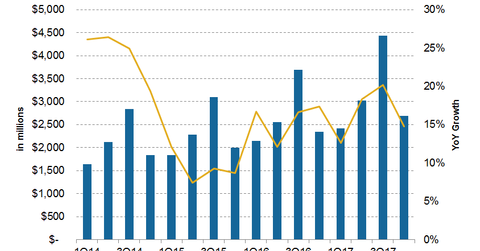

After Priceline (PCLN) released its 3Q17 results, analysts’ estimates for 2017 and 2018 were revised downwards. For the fourth quarter of 2017, sales are expected to grow 14.8% year-over-year or YoY to $2.7 billion.

Nov. 10 2017, Updated 10:31 a.m. ET

Revenue estimates

After Priceline (PCLN) released its 3Q17 results, analysts’ estimates for 2017 and 2018 were revised downwards. For the fourth quarter of 2017, sales are expected to grow 14.8% year-over-year or YoY to $2.7 billion.

Revenue had risen 12.6% YoY, 18.3% YoY, and 20.1% YoY in 1Q17, 2Q17, and 3Q17, respectively. This rise could lead to full-year 2017 sales growth of 16.9% YoY to $12.6 billion.

EBITDA estimates

EBITDA (earnings before interest, tax, depreciation, and amortization) for the fourth quarter of 2017 is expected to rise 6.7% YoY to $926.7 million. EBITDA has risen -6.1% YoY, 12.3% YoY, and 15.0% YoY in 1Q17, 2Q17, and 3Q17, respectively. This rise could lead to full-year EBITDA growth of 13.9% YoY to $4.7 billion.

EBITDA growth for 2017 has come through revenue growth as EBITDA margins have fallen throughout the year. First-quarter margins fell to 26.2% from 31.3% in 1Q16. Second-quarter margins fell to 32.2% from 33.9% in 2Q16. Third-quarter margins fell to 49.3% from 51.1% in 3Q16.

For the fourth quarter, margins are expected to decline to 34.4% from 37% in 4Q16, which could lead to full-year 2017 margins of 37.6%, lower than 2016 margins of 38.5%.

Earnings estimates

Earning per share or EPS for the fourth quarter of 2017 are expected to fall slightly, by 0.1% YoY to $14.8 per share. EPS for 1Q17 grew -6.3% YoY, EPS for 2Q17 grew 8.7% YoY, and EPS for 3Q17 grew 13.0% YoY. This growth could lead to full-year EPS growth of 13.9% YoY to $4.7 billion.

Investors can gain exposure to Priceline (PCLN) by investing in the PowerShares DWA Consumer Cyclicals Momentum Portfolio ETF (PEZ). Priceline has the second-highest weight in PEZ of ~4.8%.

PEZ also invests 2.6% of its portfolio in Expedia (EXPE). However, this ETF has no exposure to online travel stocks TripAdvisor (TRIP) and Ctrip International (CTRP).