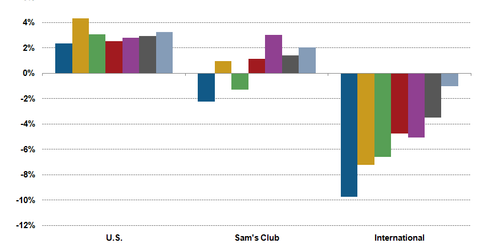

Walmart: Segments’ Sales Trends in Fiscal 2018

During the last reported quarter, the Walmart U.S. segment’s sales rose 3.3% year-over-year to $78.7 billion, reflecting a 1.8% increase in comps.

Nov. 14 2017, Updated 7:31 a.m. ET

Assessing growth in the Walmart U.S. segment

Walmart’s (WMT) strong rebound in fiscal 1H18 has been driven by the healthy performance of its Walmart U.S. (SPY) segment, which generates the majority of the company’s sales and profits. The Walmart U.S. segment continues to shine and has reported positive comparable-store sales (or comps growth) in the last 12 consecutive quarters.

Traffic has improved in the last 11 quarters. Going forward, this segment is projected to mark higher sales driven by growth across all store formats. Surging digital sales are expected to supplement the segment’s comps.

During the last reported quarter, the Walmart U.S. segment’s sales rose 3.3% YoY (year-over-year) to $78.7 billion, reflecting a 1.8% increase in comps. Its traffic increased 1.3%, and the segment’s average ticket size rose 0.5%.

Going forward, the company’s management expects comps at Walmart U.S. to increase 1.5%–2.0% in fiscal 3Q18, reflecting higher store traffic. In comparison, Target’s (TGT) comps are also expected to grow, driven by investment in price and higher e-commerce sales.

Walmart’s value pricing and e-commerce initiatives are expected to drive the segment’s top-line growth. Fresh offerings through reduced supply chain days and ease of shopping—including the expansion of online grocery pickup services and pickup discounts—could help its sales growth.

Walmart’s International business

Walmart’s International segment is showing signs of improvement on a sequential basis and is witnessing improved comps across most of its markets. During the last reported quarter, the segment’s comps showed improvement in nine of its 11 markets, with Canada and Mexico reporting higher sales.

However, sales declined on a YoY basis as adverse currency rates subdued the segment’s growth. Going forward, improved results in China (FXI), Canada, and Mexico are expected to drive the segment’s sales. However, adverse currency movement could hurt the segment’s top line.

Sam’s Club sees a healthy trend

Sales at Walmart’s Sam’s Club are growing at a decent rate. Value pricing and multichannel offerings are driving the segment’s top-line growth rate. During the last reported quarter, the segment’s comps improved 1.2%, marking the sixth consecutive quarter with positive comps growth.

Going forward, the segment is expected to grow 1%–1.5% (excluding fuel) in fiscal 3Q18. However, lower pricing and increased competition from Costco (COST) could pull its growth down.