Wall Street Analysts’ Recommendations for TechnipFMC

In this article, we’ll look at Wall Street analysts’ recommendations for TechnipFMC (FTI) on November 9.

Nov. 20 2020, Updated 11:38 a.m. ET

Wall Street’s recommendations for TechnipFMC

Analysts’ rating for TechnipFMC

On November 9, 59% of Wall Street analysts tracking TechnipFMC rated it a “buy” or equivalent. Approximately 32% rated it a “hold” or equivalent while the remaining 9% of analysts tracking FTI recommended a “sell” or some equivalent. Approximately 43% of sell-side analysts tracking Basic Energy Services (BAS) rated it a “buy” or equivalent on November 9 while 57% rated it a “hold.”

Analysts’ rating changes for FTI

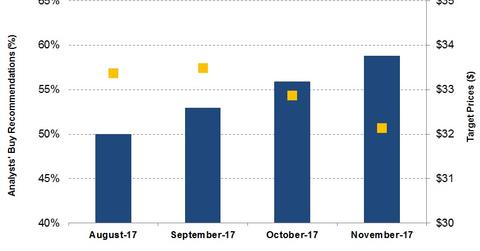

From August 9 to November 9, the percentage of analysts recommending a “buy” or some equivalent for FTI rose from 50% to 59%. Analysts’ “hold” recommendations fell during the period. A year ago, all sell-side analysts recommended a “hold” for FTI. TechnipFMC is 0.73% of the iShares North American Natural Resources ETF (IGE). IGE has fallen 6% since January 17 versus an 18% fall in FTI’s stock price.

Analysts’ target prices for FTI and peers

Wall Street analysts’ mean target price for FTI on November 9 was $32.1. FTI is currently trading at ~$28.9, implying ~11% return potential at its current price. A month ago, analysts’ average target price for FTI was $32.9.

The mean target price surveyed among sell-side analysts for Oceaneering International (OII) was $20.7. FTI is currently trading at ~$20.7, implying zero returns at its current price. The mean target price surveyed among sell-side analysts for Oil States International (OIS) was ~$25.1. OIS is currently trading at ~$24, implying ~6% upside at its current price.

Learn more about the OFS industry in Market Realist’s The Oilfield Equipment and Services Industry: A Primer. Also read Market Realist’s Which Oilfield Service Stocks Look Attractive in 4Q17?.