Basic Energy Services Inc

Latest Basic Energy Services Inc News and Updates

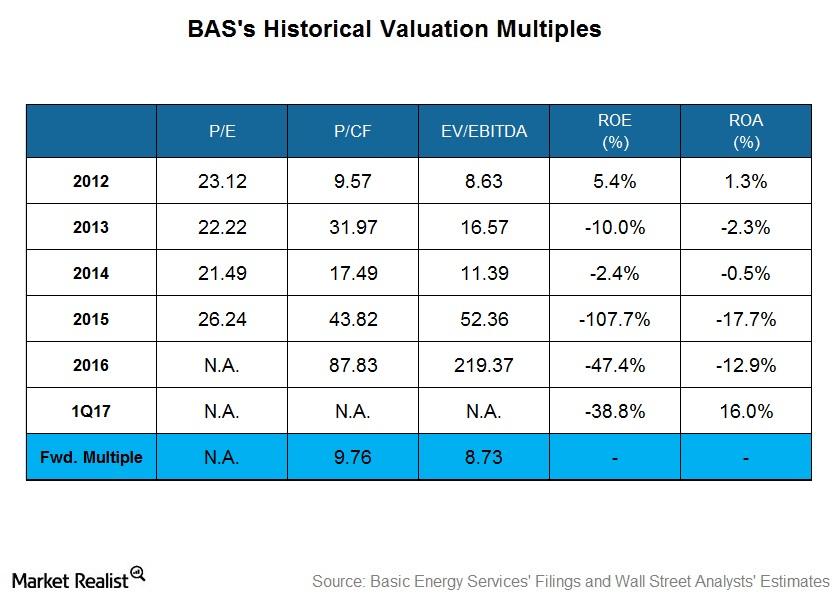

What Does Basic Energy Services’ Historical Valuation Suggest?

On March 31, 2017, Basic Energy Services’ (BAS) stock price had fallen 6% from December 30, 2016.

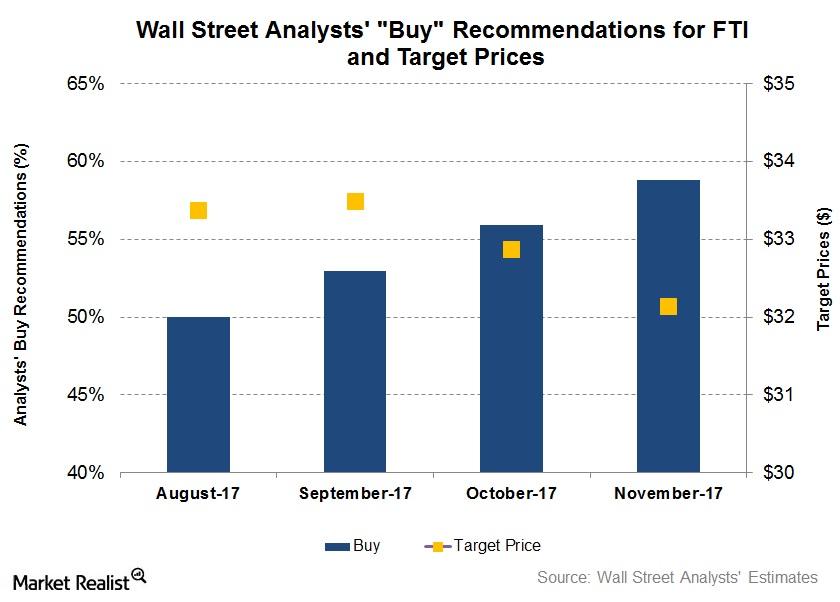

Wall Street Analysts’ Recommendations for TechnipFMC

In this article, we’ll look at Wall Street analysts’ recommendations for TechnipFMC (FTI) on November 9.

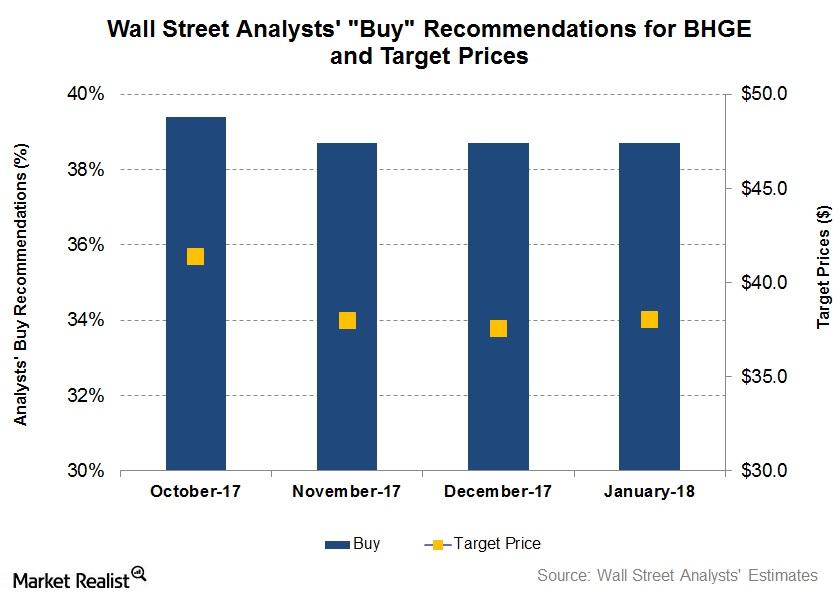

Wall Street’s Forecasts for Baker Hughes after Its 4Q17 Earnings

In this article, we’ll look at Wall Street analysts’ forecasts for shares of Baker Hughes, a GE company (BHGE) following its 4Q17 earnings release.

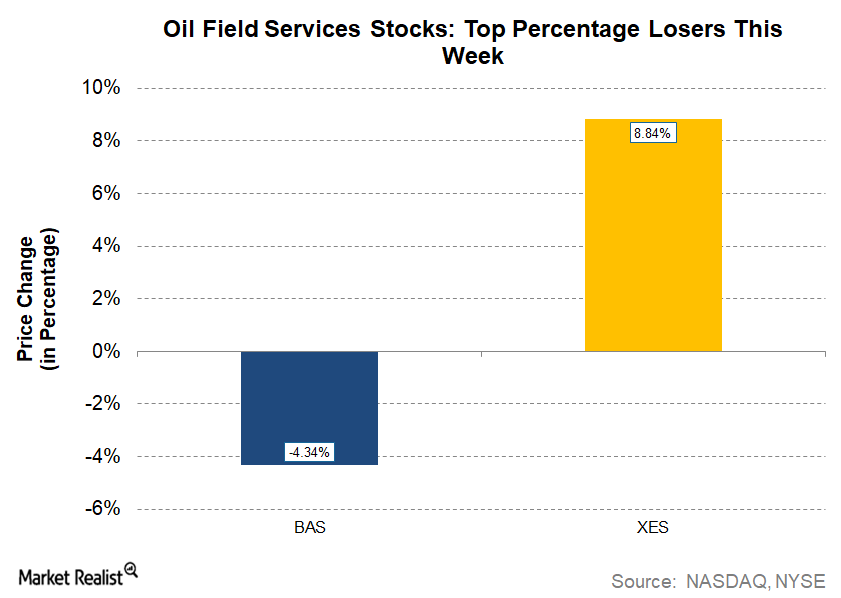

Basic Energy Services: The Only Declining Oilfield Services Stock

In the week starting September 11, Basic Energy Services (BAS) fell from $15.66 to $14.98—a decrease of ~4%.

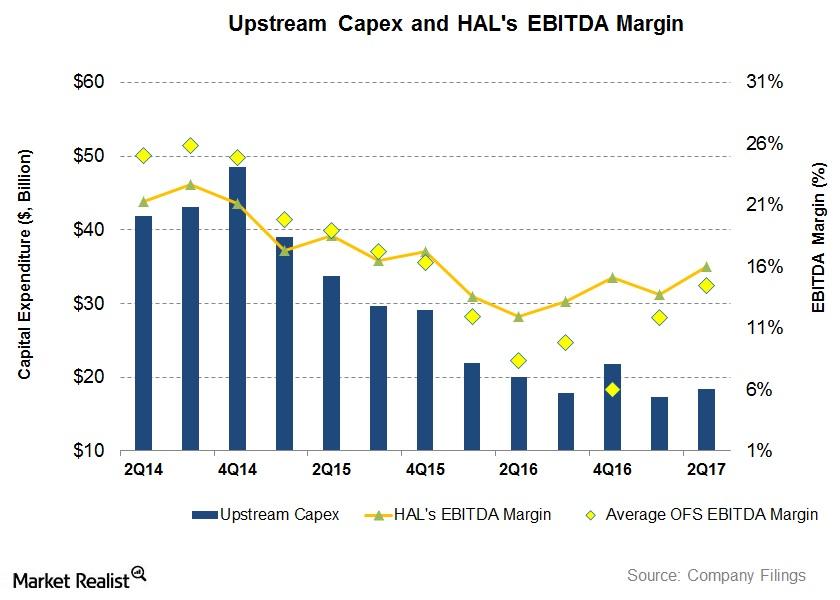

What Halliburton’s Margin Has to Do with Upstream Operators’ Capex

From 2Q16 to 2Q17, Halliburton’s (HAL) EBITDA margin (or EBITDA as a percentage of revenues) rose from 12% to 16%.

The Importance of Specialty Chemicals in the Oil Industry

Specialty oilfield chemicals are used in the oil and gas industry to improve well performance by making exploration and production more efficient.