Valuation Multiples: Comparing Home Depot, Lowe’s, and Peers

Valuation multiples help investors determine market values for comparable companies. For our analysis, we consider forward PE (price-to-earnings) multiples due to high visibility in Home Depot (HD) and Lowe’s Companies’ (LOW) earnings.

Dec. 1 2017, Updated 7:31 a.m. ET

Valuation multiple

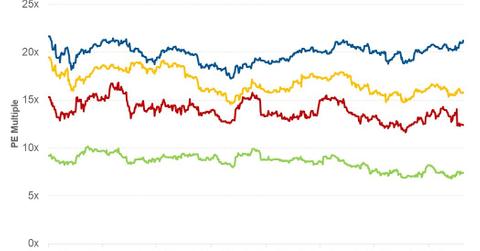

Valuation multiples help investors determine market values for comparable companies. For our analysis, we consider forward PE (price-to-earnings) multiples due to high visibility in Home Depot (HD) and Lowe’s Companies’ (LOW) earnings. A forward PE multiple is calculated by dividing a company’s stock price from analysts’ earnings estimate for the next four quarters.

Forward PE multiple

The strong 3Q17 earnings and raising of 2017 guidance appear to have increased investors’ confidence, leading to a rise in Home Depot’s stock price and valuation multiple. As of November 27, Home Depot was trading at 21.2x, compared to 20.4x before the announcement of its 3Q17 earnings.

On the same day, Lowe’s was trading at 15.8x, compared to 16.2x before the announcement of its 3Q17 earnings. Despite posting strong 3Q17 earnings, the company’s management didn’t raise its guidance for 2017, which appears to have made investors skeptical about the company’s future earnings, leading to a fall in the company’ stock price and its valuation multiple.

On the same day, peers Williams-Sonoma (WSM) and Bed Bath & Beyond (BBBY) were trading at 12.4x and 7.4x, respectively.

Growth prospects

For the next four quarters, analysts expect Home Depot and Lowe’s EPS to rise 12.0%, and 10.6%, respectively. This EPS growth could have been factored into the companies’ respective current stock prices. If the companies fail to register earnings in line with analysts’ expectations, selling pressure could bring the stock prices, as well as valuation multiples, down.

Next, we’ll look at analysts’ recommendations for Home Depot and Lowe’s.