Why Vale Believes the Iron Ore Market Is in Balance

Vale’s (VALE) Ferrous division accounted for ~87.6% of its adjusted EBITDA in 3Q17, compared with ~82.0% in 2Q17.

Nov. 7 2017, Updated 12:15 p.m. ET

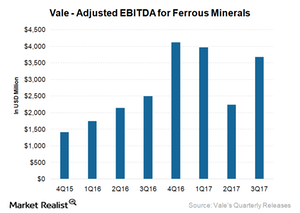

EBITDA increased in 3Q17

Vale’s (VALE) Ferrous division accounted for ~87.6% of its adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) in 3Q17, compared with ~82.0% in 2Q17. The division’s EBITDA rose 47.0% YoY (year-over-year) and 65.0% QoQ (quarter-over-quarter).

The remarkable improvement in earnings is mainly due to the 13.0% QoQ rise in the iron ore price benchmark. High premiums, higher volumes, and lower costs also helped the company achieve higher EBITDA in 3Q17.

Factors supporting EBITDA increase

Vale (VALE) believes that the iron ore market will stay in balance. During its 3Q17 earnings call, Peter Poppinga, executive director of the Ferrous Minerals and Coal division, noted that these prices are expected to exceed $65 per ton.

Poppinga based this statement on the forward curve for 1H18 on the Dalian Stock Exchange, observing that because people believe that after the restrictions on steel production are canceled, the prices could rise.

Vale’s iron ore price realization for 3Q17 was $76.10 per ton, or ~25% higher than in 2Q17. A rise in the iron ore price benchmark during the quarter, in addition to higher premiums, led to this sequential rise in realizations.

Vale’s iron ore volumes in 3Q17 totaled 76.4 million tons, compared with 69.0 million tons in 2Q17. The ramp-up of Vale’s S11D mine is helping its volumes.

While Vale’s price realization improved during the quarter, its C1 cash costs fell $0.70 per ton from $15.20 per ton in 2Q17 to $14.50 per ton in 3Q17. Higher fixed cost dilution, lower maintenance, and demurrage costs led to unit cost improvement.

Peer costs

Peer (PICK) Rio Tinto (RIO) had a unit cost of $13.80 per ton for its Pilbara operations in 1H17. BHP’s (BHP) unit costs for fiscal 2017 (ended June 2017) was $14.60 per ton. Cleveland-Cliffs (CLF), which has different drivers than its seaborne peers, also reduced its production costs in the United States.

Next, we’ll look at how Vale’s focus on costs is affecting the profitability of its Coal division.