How the Higher Dollar Has Affected Precious Metals

Precious metal slump All four precious metals saw a down day on Monday, November 20. Gold fell 1.6% to $1,275.30 per ounce, after touching a one-month high on Friday, November 17. The fall in precious metals was most likely due to the rise in the US dollar. The US Dollar Index rose 0.45% on Monday. Gold, silver, platinum, […]

Nov. 23 2017, Updated 10:32 a.m. ET

Precious metal slump

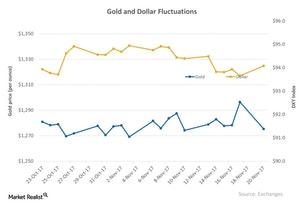

All four precious metals saw a down day on Monday, November 20. Gold fell 1.6% to $1,275.30 per ounce, after touching a one-month high on Friday, November 17. The fall in precious metals was most likely due to the rise in the US dollar. The US Dollar Index rose 0.45% on Monday.

Gold, silver, platinum, and palladium fell 1.6%, 3.1%, 3.2%, and 0.68%, respectively, due to the higher dollar. A stronger US dollar is often negative for precious metals, as they are dollar-denominated assets. A higher dollar means investors from other countries have to spend more of their home currency to buy dollar-based assets.

Euro weakness

The above chart depicts the movement of gold in accordance with the US Dollar Index (UUP). The rebound in the dollar on Monday was mostly due to euro weakness against the dollar after German Chancellor Angela Merkel failed to form a three-way coalition government.

The US dollar may receive further support if there is an interest rate hike next month, which we’ll discuss in the next part of this series. The strength of the dollar also affected precious metal funds such as the Global X Silver Miners ETF (SIL) and the VanEck Vectors Gold Miners ETF (GDX), which fell 1.3% and 1.1%, respectively. Miners that fell included Wheaton Precious Metals (SLW), Yamana Gold (AUY), Pan American Silver (PAAS), and AngloGold Ashanti (AU), which fell 2.2%, 3.3%, 1.5%, and 1.7%.