3M: Analysts Revised the Target Price

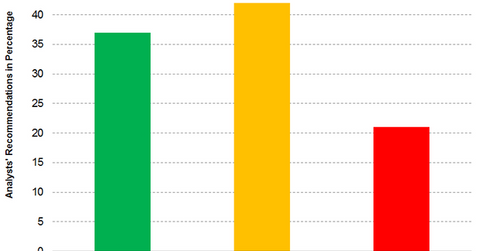

For 3M stock, 37% of the analysts recommended a “buy,” 42% recommended a “hold,” and 21% recommended a “sell.”

Nov. 23 2018, Updated 12:00 p.m. ET

Analysts’ consensus

Analysts’ interest in 3M (MMM) has been increasing gradually since its third-quarter earnings. Currently, there are 19 active analysts tracking 3M stock. Among the analysts, 37% recommended a “buy,” 42% recommended a “hold,” and 21% recommended a “sell.” Analysts’ views and recommendations are widely followed by investors to track the stock price movement.

Analysts’ consensus indicates a target price of $205.13 for 3M, which implies a return potential of 3.2% over the closing price on November 21. In the past three months, analysts have reduced their target price on 3M from $210.00 to the current target price of $205.13, which indicates that the overall outlook isn’t so bullish. 3M has been continuously reducing its EPS for fiscal 2018. 3M didn’t meet analysts’ expectations in the previous quarter. However, 3M’s continued capital deployment is seen as a positive development for future growth. As a result, most of the analysts recommended a “hold.”

Brokerages’ recommendations

- Barclays (BCS) has cut its target price for 3M from $195 to $190. Currently, the stock is trading above the recommended target price as of the closing on November 21.

- Credit Suisse (CS) has raised its target price for 3M to $230.00, which implies a return potential of 15.8% over its closing price on November 21.

- RBC (RY) has also raised 3M’s target price to $226 from $223, which implies a return potential of 12.2% over the closing price on November 21.

Investors can hold 3M indirectly by investing in the iShares U.S. Industrials ETF (IYJ), which has 3.7% of its portfolio in 3M as of November 21.