Analyzing Wall Street Targets for DK, ANDV, and CVE

As of November 23, 2017, four of the 14 analysts covering Delek US Holdings (DK) stock gave it a “strong buy” recommendation, and five gave it a “buy.”

Nov. 29 2017, Updated 9:03 a.m. ET

Wall Street recommendations for the leading gainers and decliners

To conclude this series, we’ll look at the biggest movers in the refining and marketing and integrated energy sectors. We’ll look at Wall Street’s recommendations for the leading gainers and decliners in the first half of last week, which we’ve been covering in this series.

Recommendations for Delek US Holdings

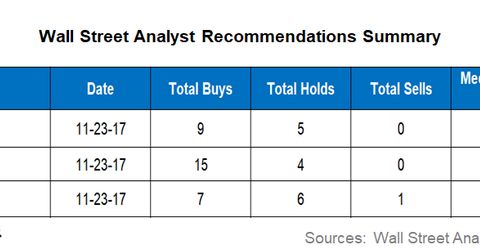

As of November 23, 2017, Reuters reported that 14 analysts were making recommendations on Delek US Holdings (DK). Four of them have “strong buy” recommendations, five have “buy” recommendations, and five have “hold” recommendations. There are no “sell” or “strong sell” ratings on the stock.

The median price target for DK is $30.50, which is ~5% lower than the closing price of $32 on November 22, 2017.

Recommendations for Andeavor

As of November 23, 2017, Reuters reported 19 analysts making recommendations on Andeavor (ANDV) stock. Four of them have “strong buy” recommendations, while 11 have “buy” recommendations. Four of them have “hold” recommendations, and there are no “sell” or “strong sell” ratings on the stock.

The median price target for ANDV is $123, which is ~18% higher than its November 22, 2017, closing price of $103.95.

Recommendations for Cenovus Energy

As of November 23, 2017, ~50% of Wall Street analysts have rated Cenovus Energy (CVE) a “strong buy” or “buy,” and ~43% have rated it a “hold.” About 7% of analysts have a “sell” or “strong sell” rating on the stock. The median price target for CVE is $14.25, which is ~47% higher than its November 22, 2017, closing price of $9.71.