A Look at the Catalonia-Troubled Euro This Week

It’s possible that political pressures could keep the euro under pressure as the economic calendar remains light in the Eurozone.

Oct. 10 2017, Updated 7:43 a.m. ET

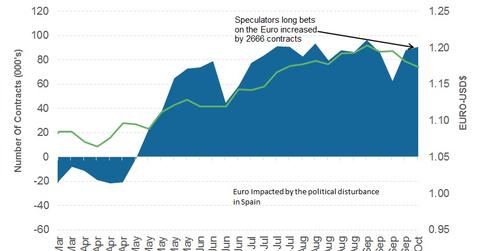

Euro closed weaker for second week in a row

The euro (FXE) closed the week ended October 6, 2017, at 1,1734 against the US dollar (UUP). The euro ended an eight-week low as political troubles in Spain look like they’re set to escalate. Catalonia, which is part of Spain, voted to seek independence from Spain in a referendum conducted two weeks ago. The Spanish courts have ruled the referendum illegal, but uncertainty surrounding the issue is likely to continue for some time and adversely impact the shared currency. Economic data from the Eurozone were mixed, with German factory orders increasing and retail sales falling.

European equity markets (VGK), however, continue to remain positive, reflecting the global trend. The German DAX (DAX) ended the week with a 0.43% rise. The Euro Stoxx (FEZ) rose 0.17%, and France’s CAC rose 0.13% the previous week.

Euro speculators increase their bets

According to the latest Commitment of Traders report released on Friday, October 6, 2017, by the CFTC (Chicago Futures Trading Commission), speculators increased their bullish bets on the euro this week.

The total net speculative bullish positions on the euro (EUFX) increased from 88,167 contracts through September 26, 2017, to 90,833 contracts as of October 3, 2017. It’s likely that speculators are trying to position themselves for another euro rally if the political crisis in Spain is resolved.

Will Catalonia and Spain drive the euro lower?

It’s possible that political pressures could keep the euro under pressure as the economic calendar remains light in the Eurozone. Mario Draghi, president of the European Central Bank, is scheduled to speak on Thursday, October 12, 2017. If his view is optimistic on the European Union, it could help the euro recover some lost ground.

In the next part of this series, we’ll analyze the movements of the British pound last week.