How Iron Mountain Has Maintained Its Dividend Yield

How Iron Mountain has maintained a 5% yield Iron Mountain (IRM) is an enterprise information management services company. The company’s revenue grew in 2016, supported by its North American Records and Information Management Business, North American Data Management Business, Western European Business, and Other International Business segments. Its revenue fell 4% in 2015 before rising 17% in 2016. Its operating income fell 5% in 2015 and 4% in 2016 due to […]

Sept. 11 2017, Published 12:33 p.m. ET

How Iron Mountain has maintained a 5% yield

Iron Mountain (IRM) is an enterprise information management services company. The company’s revenue grew in 2016, supported by its North American Records and Information Management Business, North American Data Management Business, Western European Business, and Other International Business segments. Its revenue fell 4% in 2015 before rising 17% in 2016. Its operating income fell 5% in 2015 and 4% in 2016 due to a 21% rise in operating expenses in 2016 and a 3.3% fall in 2015.

Iron Mountain’s earnings per share

Iron Mountain’s interest expenses rose 18% in 2016. Its EPS (earnings per share) fell 65% in 2015 and 28% in 2016. Its 2015 EPS were impacted by high expenses and low gains on real estate assets.

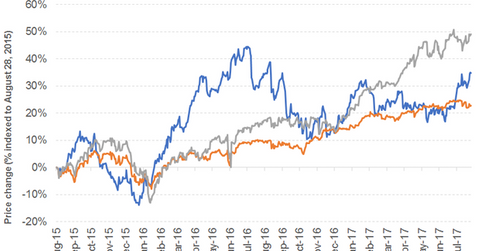

The company had a debt-to-equity ratio of 3.1x in 2016. The company’s stock outperformed the business services industry and the S&P 500 in 2016, and has continued to do so this year.

Impressive dividend yield

Iron Mountain’s revenue grew 7.5% in 1H17, driven by all segments. Its operating income grew 76% due slightly lower operating expenses. Its 1H17 EPS ended up in positive territory, despite a 20% increase in interest expenses. The EPS were boosted by other income and a gain on the sale of real estate assets.

Iron Mountain’s dividend yield has been quite impressive, despite falling since 2015 due to stock price appreciation. The First Trust Morningstar Dividend Leaders ETF (FDL) offers a dividend yield of 3.3%, at a PE (price-to-earnings) ratio of 19.9x. The ETF has a 2% exposure to small-cap stocks. The PowerShares High Yield Equity Dividend Achievers ETF (PEY) has a substantial stake in utilities and offers a dividend yield of 2.8%, at a PE ratio of 18.6x. The ETF has a 28% exposure to small caps.