What Are Analysts’ Recommendations for Ford?

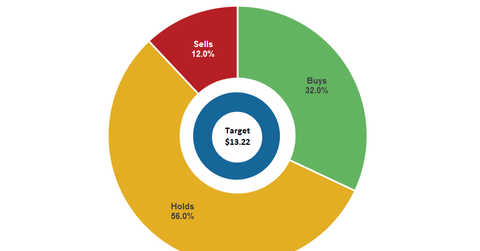

According to the latest Bloomberg consensus, 32% of analysts covering Ford rated it as a “buy,” 56% rated it as a “hold,” and three rated it as a “sell.”

Nov. 20 2020, Updated 12:10 p.m. ET

Analysts’ recommendations for Ford

According to the latest Bloomberg consensus, 32% of analysts covering Ford (F) have given the company “buy” recommendations, while 56% of the analysts maintained neutral views and recommended a “hold.” Only three analysts among the 25 covering the company’s stock recommended a “sell.”

If popular Wall Street analysts change their views, significant short-term movement in the stock’s price could occur. Therefore, it’s important for investors to pay attention to these analysts’ recommendations on Ford.

Investors’ concerns about Ford’s ability to achieve its fiscal 2016 guidance could be the primary reason for this neutral view. As we noted in the first part of this series, during its 2Q16 earnings event, Ford highlighted the risks and challenges it might face while attempting to achieve its 2016 guidance.

Target prices

As of September 28, 2016, Ford’s consensus 12-month target price was $13.22 with an upside potential of ~9.3% from its market price of $12.09.

Among notable analysts, Colin Langan of UBS has the highest price target of $16 for the company—an impressive ~32.3% upside potential. Likewise, Ryan Brinkman of JPMorgan Chase also recommends a “buy” with a price target of $15 and a return potential of ~24%.

Adam Jonas of Morgan Stanley maintains a negative to neutral view on the company’s stock. He expects it to underperform the broader market. He maintains a low target price of $12 for the stock.

Recommendations for peers

Analysts’ estimates for the 12-month return potential of Ford’s peers (IYK) as of September 28, 2016, are as follows:

- General Motors (GM) – 46.2% of the analysts gave it a “buy” with ~16.8% upside potential.

- Fiat Chrysler Automobiles (FCAU) – 46.4% of the analysts gave it a “buy” with ~34.2% upside potential.

- Tesla Motors (TSLA) – 38.1% of the analysts gave it a “buy” with ~21.6% upside potential.

- Honda (HMC) – 33.3% of the analysts gave it a “buy” with ~11.1% return potential.

To learn more about Ford Motor Company’s business and history, read A Must-Read Guide to Ford Motor Company, an Auto Industry Pioneer.

You can read about automakers’ efforts in the development of autonomous vehicles in Steering the Auto Industry: Investor’s Guide to Autonomous Vehicles.

Read Do August Vehicle Sales Point to a Slowing US Economy? to learn about US auto sales in August.