Analysts’ Estimates: Could NEM’s Near-Term Profitability Decline?

Although 2017 has not been very good for Newmont Mining stock due to short-term issues, its outlook remains strong.

Nov. 20 2020, Updated 4:03 p.m. ET

Factors impacting Newmont’s estimates

Newmont Mining (NEM) has emerged as a more flexible mining company over the past few years by shedding its non-core assets. It is also ahead of its debt reduction target, restoring investors’ optimism in the stock. Although 2017 has not been very good for Newmont Mining stock due to short-term issues, its outlook remains strong.

NEM improved its production and cost outlook for 2017 slightly in its 2Q17 results. Please read Newmont Mining Digs in after a Strong 2Q17 for more details.

Analysts’ revenue estimates

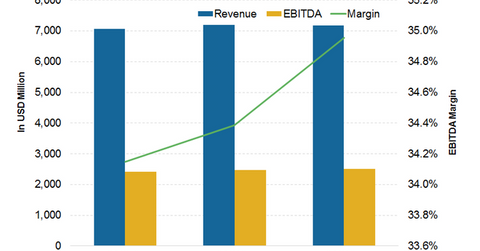

The consensus is calling for revenues of ~$7.3 billion for 2017, implying year-over-year (or YoY) growth of 8.1%. Its revenues for 2018, however, are expected to rise 2.1% YoY. Newmont Mining’s new production at its Merian and Long Canyon mines is mainly responsible for the growth in revenues in 2017.

During its 2Q17 results, Newmont Mining upgraded its production guidance on the expectation of full potential improvements in North America and Africa. The further growth in revenue expectations is currently muted.

Analysts expect the company’s 2018 revenues to show 0.4% growth. It, however, has an upside as more of Newmont Mining’s projects come online.

Earnings estimates

Newmont expects its costs to increase over the next two years due to mine-specific factors. You can read Market Realist’s Why Newmont Mining’s Unit Costs Could Trend Higher Going Forward for more details.

Due to these higher expected costs, analysts are estimating slightly lower EBITDA[1. earnings before interest, tax, depreciation, and amortization] margin of 35.8% for NEM for 2017 compared to 37.9% in 2016. Over the longer term, however, the company’s unit costs should trend downward as new projects with lower unit costs begin.

Newmont Mining’s peers (GDX) (RING) Barrick Gold (ABX), Goldcorp (GG), Agnico Eagle Mines (AEM), and Yamana Gold (AUY) have also trimmed costs considerably over the past year.