Round 3: Will Brexit Negotiations Help the British Pound?

The British pound (FXB) remained unchanged against the US dollar for the week ending August 25. The pound (GBB) closed the week at 1.2887.

Aug. 28 2017, Updated 4:36 p.m. ET

Pound remained unchanged against the US dollar

The British pound (FXB) remained unchanged against the US dollar for the week ending August 25. The pound (GBB) closed the week at 1.2887—it rose 0.09% against the US dollar (UUP). The second quarter GDP was reported at 0.3%. Last week, no other data had an impact. The pound’s price action was mostly driven by the US dollar.

British equity markets (BWX) continued to remain positive. The FTSE 100 Index (EWU) posted a gain of 1.1% for the week ending August 25.

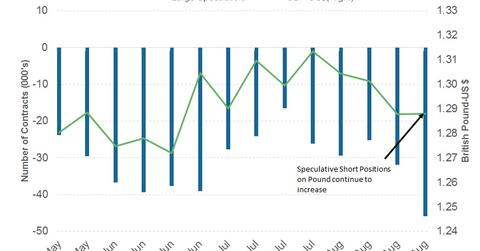

Speculators continued to reduce short positions

According to the latest “Commitment of Traders” report released on August 25 by the Commodity Futures Trading Commission, speculators continue to remain short on the British pound. There was an increase of 14,040 contracts against the British pound, which took the total net short position to -45,900 contracts.

What to expect from the pound this week

The United Kingdom’s economic data are limited for the week. Consumer confidence numbers will be reported on Thursday, followed by Markit’s manufacturing PMI data on Friday. The key focus would be on the third round of Brexit negotiations between the European Union and the United Kingdom. The third round of negotiations would include citizens’ rights and the amount that the United Kingdom will pay the European Union as a Brexit settlement. A weak political mandate in the United Kingdom ups the discussions’ uncertainty quotient. The weak political mandate will likely add to the British pound’s woes.