Manufacturing Activity in Indonesia Contracted in July 2017

Manufacturing activity in Indonesia (EEM) in July 2017 fell at its fastest pace in the last 19 months mainly due to the sharp decline in its output.

Aug. 4 2017, Updated 7:37 a.m. ET

Manufacturing activity in Indonesia

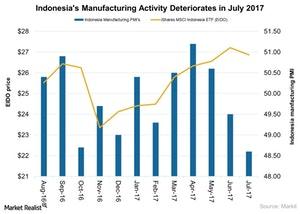

Manufacturing activity in Indonesia (EEM) in July 2017 fell at its fastest pace in the last 19 months mainly due to the sharp decline in its output. Manufacturing PMI in Indonesia (EIDO) fell to 48.6 in July 2017 as compared to 49.5 in June 2017. New orders also continued to fall in July 2017 in line with the prior month. Let’s look at manufacturing activity over the last year in the below chart.

Manufacturing activity in July 2017

Indonesia’s (IDX) manufacturing PMI fell sharply in July 2017 mainly due to the sharp accelerated drop in production. The reduction in new order work resulted in a sharp fall in output in July 2017. The contraction in some key variables led to a contraction in the headline manufacturing PMI as of July 2017 in Indonesia. The overall weak demand, challenging economic conditions, and postponement of client orders led to declining output in July 2017.

Sluggish international demand

The foreign demand for Indonesian (IEMG) manufactured goods also fell, resulting in a fall in the total new work orders in July 2017. The new export orders fell slightly but ended the three-month sequence of expansion as of July 2017.

Purchasing activity and employment

Weaker client demand led to reduced spending resulting in a decrease in both employment and purchasing activity in July 2017. The purchasing dropped for the first time since January 2017, and job cuts continued for ten straight months as of July 2017. The price pressures remained soft as input cost increased at the slowest rate year-to-date and output prices remained at two-month lows.

Impact

The deterioration in operating conditions in Indonesia (ASEA) affected the business sentiment in July 2017. The companies still expect output to increase in the next 12 months. However, the degree of confidence has dropped to the lowest level since April 2013 and is much weaker than the long-run average.

The exports are predicted to improve with robust global economic growth and higher global commodity prices in 2017. The rise in commodity prices is expected to improve the performance of the mining and agricultural sectors, which in turn is expected to benefit secondary sectors like manufacturing in 2017.

Let’s look at consumer confidence in Indonesia in our next article.