How Starbucks Obtained a Wide Economic Moat Rating

Cost Advantage in Action: Four Case Studies of Moat Companies To demonstrate the power of cost advantages in creating economic moats, we highlight four moat companies: U.S. based Starbucks and Compass Mineral, and international moat companies: Kao (Japan) and Ramsay Health Care (Australia). Starbucks Corp (SBUX US) boasts a “wide economic moat” rating from Morningstar from […]

Oct. 29 2019, Updated 11:38 p.m. ET

Cost Advantage in Action: Four Case Studies of Moat Companies

To demonstrate the power of cost advantages in creating economic moats, we highlight four moat companies: U.S. based Starbucks and Compass Mineral, and international moat companies: Kao (Japan) and Ramsay Health Care (Australia).

Starbucks Corp (SBUX US) boasts a “wide economic moat” rating from Morningstar from two sources: its strong brand intangible asset and cost advantages: “We view Starbucks as one of the most compelling growth stories in the global consumer space today, poised for top-line growth and margin expansion through menu innovations, sustainable cost advantages, and evolution into a diversified retail and consumer packaged goods platform.” Starbucks is best known for producing and serving premium coffee and espresso, and distributes a wide range of packaged products under several brand names. The company operates more than 13,500 locations in the U.S. (26,000 globally), which represents a sizable lead over competitor Dunkin’ Donuts 8,900 U.S. locations. Morningstar believes that Starbucks has developed a strong brand that commands premium pricing and meaningful scale advantages and that Starbucks should be able to maintain its leadership position while successfully accessing new growth avenues.

Market Realist

How Starbucks obtained a competitive advantage

Seattle-based Starbucks Corporation (SBUX) operates 26,736 restaurants, comprising 13,249 company-owned restaurants and 13,487 franchised restaurants worldwide as a roaster, marketer, and retailer of specialty coffee.

In its third quarter of fiscal 2017, Starbucks’ net revenues grew 8.0% to $5.7 billion, with global comparable store sales rising 4.0% year-over-year (or YoY). The company opened 575 net new stores globally in the third quarter, bringing the total count to 26,736. This overall revenue growth was led by the addition of new stores, improving same-store sales growth, and increasing revenues in the Americas segment, the China/Asia-Pacific segment, and the Channel Development segment.

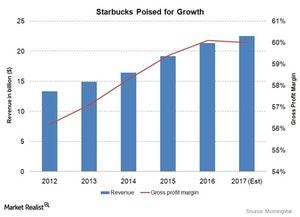

The chart above shows the company’s revenues and profit margins poised for growth, rising each year. For fiscal 2017, analysts estimate its operating margin to be in line and for its revenues to grow 5.5% YoY.

After suffering declining revenues due to intense competition from McDonald’s (MCD) and Dunkin’ Brands (DNKN) in 2009, Starbucks opted to keep its costs lower to gain a competitive advantage. The company renegotiated its outsourcing agreements to bring down $500 million in operating expenses in 2012. The company also opened a fourth manufacturing plant in South Carolina to reduce its transportation costs.

Starbucks uses another source of competitive advantage (MOAT)—the intangible asset (PEP) of creating a strong brand by providing premium-quality coffee. Strong brands drive customer’s buying habits. The company also focuses on product innovation by adapting to changing consumer tastes and preferences.