Eliquis and Sprycel Could Boost BMY’s Revenue Growth in 2H17

In July 2017, the FDA accepted Bristol-Myers Squibb’s supplemental New Drug Application (or sNDA) for expanding the indication of Sprycel.

Nov. 20 2020, Updated 12:19 p.m. ET

Eliquis’s revenue trends

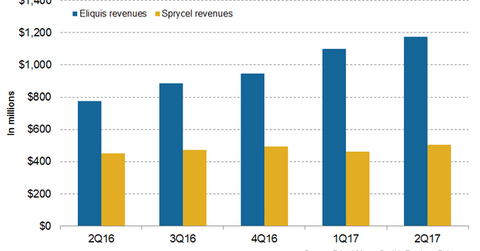

In 2Q17, Bristol-Myers Squibb’s (BMY) Eliquis generated revenues of around $1.2 billion, which reflected ~51% growth on a year-over-year (or YoY) basis and ~7% growth on a quarter-over-quarter basis.

In 2Q17, in the US market, Eliquis generated revenues of around $703 million, which reflected ~58% growth on a YoY basis. In 2Q17, outside the US market, Eliquis generated revenues of around $473 million, which represents ~42% growth on a YoY basis.

Eliquis contributed to ~23% of Bristol-Myers Squibb’s net revenues in 2Q17. To know more about Eliquis, please refer to This Could Significantly Drive Bristol-Myer Squibb’s Revenue Growth. The chart below represents the revenue trajectory of Eliquis and Sprycel from 2Q16 to 2Q17.

Sprycel revenue trends

In 2Q17, Bristol-Myers Squibb’s Sprycel generated revenues of ~$506 million, which reflected ~12% growth on a YoY basis and 9% growth on a quarter-over-quarter basis.

In 2Q17, in the US market, Sprycel generated revenues of around $281 million, which represents ~21% growth on a YoY basis. In 2Q17, outside the US market, Sprycel generated revenues of around $225 million, which reflects ~3% growth on a YoY basis. To learn more about Sprycel, please read What Sprycel Could Mean for Bristol-Myers Squibb.

Recent regulatory submissions

In July 2017, the FDA accepted Bristol-Myers Squibb’s supplemental New Drug Application (or sNDA) for expanding the indication of Sprycel. This treatment is appropriate for the treatment of children with Philadelphia chromosome-positive chronic phase chronic myeloid leukemia (or CML). Bristol-Myers Squibb’s sNDA to the FDA is under priority review, and the FDA has provided a Prescription Drug User Fee Act (or PDUFA) action date of November 9, 2017.

In the CML drugs market, Bristol-Myers Squibb’s Eliquis competes with Novartis’s (NVS) Tasigna, and Gleevec. It also competes with Ariad Pharmaceuticals’ (ARIA) Iclusig and Pfizer’s (PFE) Bosulif.

The growth in the sales of Eliquis and Sprycel could boost the prices of the PowerShares Dynamic Pharmaceuticals Portfolio ETF (PJP). Bristol-Myers Squibb comprises ~2.1% of PJP’s total portfolio holdings.