ARIAD Pharmaceuticals Inc

Latest ARIAD Pharmaceuticals Inc News and Updates

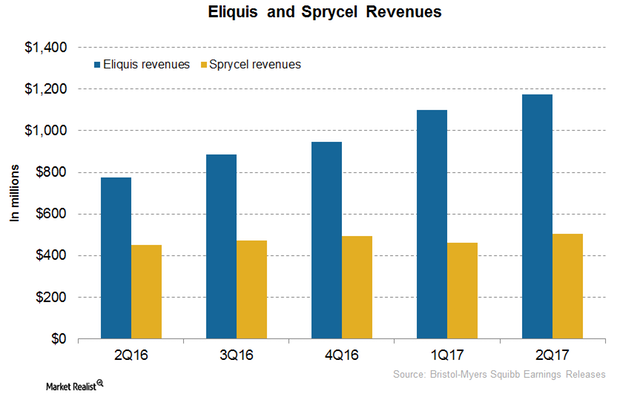

Eliquis and Sprycel Could Boost BMY’s Revenue Growth in 2H17

In July 2017, the FDA accepted Bristol-Myers Squibb’s supplemental New Drug Application (or sNDA) for expanding the indication of Sprycel.

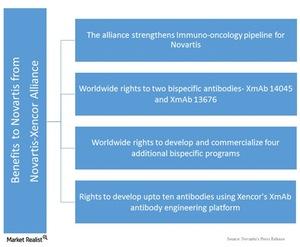

How Could the Novartis-Xencor Alliance Benefit Novartis?

As we’ve discussed, Novartis (NVS) is one of the largest pharmaceutical companies by revenue.