Will Starbucks’s Fiscal 3Q17 Earnings Boost Its Stock Price?

Starbucks (SBUX) is scheduled to announce its fiscal 3Q17 earnings after the market closes on July 27, 2017. Starbucks’ fiscal 3Q17 extends from April 3, 2017.

Nov. 20 2020, Updated 1:54 p.m. ET

Stock performance

Starbucks (SBUX) is scheduled to announce its fiscal 3Q17 earnings after the market closes on July 27, 2017. Starbucks’ fiscal 3Q17 extends from April 3, 2017.

In fiscal 2Q17, Starbucks posted adjusted EPS (earnings per share) of $0.45 on revenues of $5.3 billion. Analysts were expecting the company to post EPS of $0.45 on revenues of $5.4 billion. The company’s same-store sales growth (SSSG) of 3.0% was below analysts’ estimate of 3.7%, leading to lower revenue. For more detailed analysis of Starbucks’s 3Q17 earnings, see Starbucks Lowered EPS Guidance after Soft Fiscal 2Q17 Sales.

Along with lower-than-expected SSSG in fiscal 2Q17, analysts’ downgrading of the stock and skepticism over Starbucks’s expansion plans in China led to a fall in the company’s stock price. As of July 14, 2017, Starbucks was trading at $58.76, which represents a fall of 4.1% since the announcement of fiscal 2Q17 earnings on April 27, 2017.

Year-to-date performance

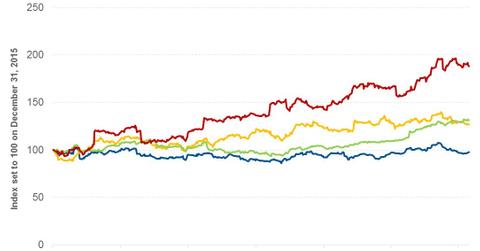

Since the beginning of 2017, Starbucks stock has returned 5.8%. During the same period, its peers Dunkin’ Brands (DNKN), McDonald’s (MCD), and Domino’s Pizza (DPZ) have returned 2.9%, 27.6%, and 31.4%, respectively.

Notably, the broader comparative indices, the iShares U.S. Consumer Services ETF (IYC) and S&P 500 INDEX, returned 9.0%, and 9.8%, year-to-date, respectively.

Series overview

In this series, we’ll look at analysts’ expectations and management’s guidance for fiscal 3Q17. We’ll also cover analysts’ estimates for the next four quarters. Finally, we’ll wrap this series up looking at Starbucks’s valuation multiple and analysts’ recommendations.

First, let’s start by looking at Starbucks’s fiscal 3Q17 revenue estimates.