Will Dunkin’ Brands’ 2Q17 Earnings Boost Its Stock Price?

Dunkin’ Brands, the owner of the Dunkin’ Donuts and Baskin-Robbins brands, is scheduled to announce its 2Q17 earnings before the market opens on July 27, 2017.

Nov. 20 2020, Updated 2:22 p.m. ET

Stock performance

Dunkin’ Brands (DNKN), the owner of the Dunkin’ Donuts and Baskin-Robbins brands, is scheduled to announce its 2Q17 earnings before the market opens on July 27, 2017.

The company’s stock price has fallen 2.9% since its announcement of its 1Q17 earnings on May 4, 2017.

In 1Q17, Dunkin’ Brands posted adjusted EPS (earnings per share) of $0.54 on revenue of $190.7 million, while analysts were expecting the company to post EPS of $0.48 on revenue of $192.2 million. In the absence of excess tax benefits, the company’s EPS stood at $0.48.

Aggressive rises in menu prices by the franchisees of both brands led to lower-than-expected same-store sales growth (or SSSG) for DNKN, which lowered the company’s revenue. This lower-than-expected SSSG appears to have made investors skeptical of Dunkin’ Brands’ future earnings, leading to a fall in its stock price.

You can read more about Dunkin’ Brands’ 1Q17 performance in Dunkin’ Brands Reiterates 2017 Guidance despite Weak 1Q17 Sales.

Year-to-date performance

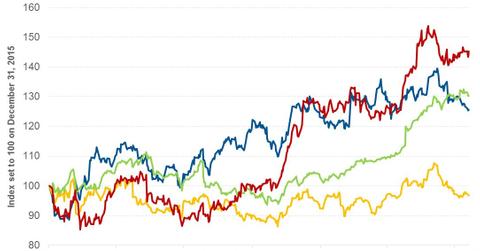

2017 has been a tough year for Dunkin’ Brands, which returned 23.1% in 2016. Year-to-date (or YTD), the company’s stock price has risen 2.1%. During the same period, its peers Starbucks (SBUX), McDonald’s (MCD), and Wendy’s (WEN) have risen 4.7%, 26.4%, and 15.8%, respectively.

The broader comparative indexes, the S&P 500 Index and the iShares U.S. Consumer Services ETF (IYC), have returned 10.5% and 10.0% YTD, respectively.

Series overview

With Dunkin’ Brands’ 2Q17 earnings around the corner, we’ll take a look at analysts’ 2Q17 expectations for the company in this series. We’ll also cover management’s 2017 guidance and analysts’ revenue and EPS estimates for Dunkin’ Brands over the next four quarters. We’ll wrap this series up by looking at Dunkin’ Brands’ valuation multiple and analysts’ recommendations for its stock.

Let’s start by looking at analysts’ revenue estimates for DNKN in 2Q17.