The Bank of Japan Cuts Its Inflation Forecast

According to the statement it released at the end of its two-day meeting on July 20, 2017, the Bank of Japan has left its monetary policy unchanged.

July 20 2017, Published 8:58 a.m. ET

July policy meeting

According to the statement it released at the end of its two-day meeting on July 20, 2017, the Bank of Japan has left its monetary policy unchanged. The bank has left interest rates at -0.1%, in line with the market’s (JPXN) expectations.

The Japanese central bank has been struggling to get the economy back on track, and it’s now extended the timeline for reaching its 2% inflation (TIP) target to 2019. The country’s core CPI (consumer price index) for 2018 is expected to remain at 1.5%, a downward revision from the previous projection of 1.7%.

There was no discussion during the meetings about the current stimulus program, and it’s likely that the current asset buying program of 80 trillion Japanese yen per year will continue. In terms of economic outlook, Bank of Japan policymakers estimated that the Japanese economy could expand 1.8% during 2017, an upward revision of 1.6% from its April estimate.

Yield curve control to continue

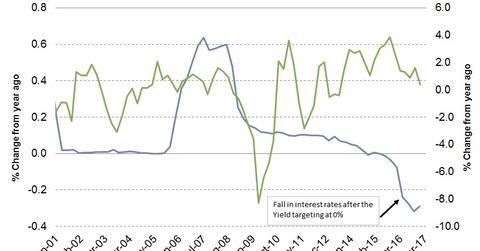

In a statement detailing the conduct of its monetary policy, the Bank of Japan stated that it would continue with its quantitative and qualitative easing program. The bank has adopted a yield curve control policy wherein it will purchase Japanese government bonds to maintain a ten-year yield target of ~0%.

The bank initiated this program to try to control rates in the medium term, as it’s exhausted its options at the shorter end of the curve, which has negative interest rates.

Lower interest rates are likely to encourage financial organizations to lend more, and that lending, in turn, is expected to increase economic activity. Incremental economic activity is likely to result in higher inflation, which the central bank is trying to achieve.