Novartis Stock in 2Q17: How Has It Performed?

A look at Novartis Headquartered in Basel, Switzerland, Novartis (NVS) is a pharmaceutical company specializing in the research, development, manufacturing, and marketing of a broad range of healthcare products, mainly pharmaceuticals. The company has segregated its business into three segments: Innovative Medicines, Sandoz (generic), and Alcon (eye care). Stock price performance Novartis’s stock price has […]

July 7 2017, Updated 10:05 p.m. ET

A look at Novartis

Headquartered in Basel, Switzerland, Novartis (NVS) is a pharmaceutical company specializing in the research, development, manufacturing, and marketing of a broad range of healthcare products, mainly pharmaceuticals. The company has segregated its business into three segments: Innovative Medicines, Sandoz (generic), and Alcon (eye care).

Stock price performance

Novartis’s stock price has risen ~11.2% in 2Q17, and 12.5% year-to-date as of July 7, 2017.

Analysts’ recommendations

Wall Street analysts estimate that the stock has the potential to return ~4.6% over the next 12 months. Analysts’ recommendations show a 12-month targeted price of $85.75 per share, compared with $81.97 per share on July 6, 2017.

Of the 30 analysts tracking Novartis stock, 14 recommend “buy,” 15 recommend “hold,” and three recommend “sell.” The consensus rating for Novartis stands at 2.5, which represents a strong “buy” for value investors.

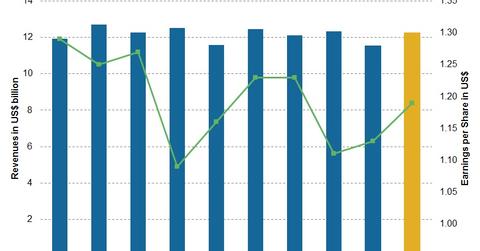

Analysts’ revenue estimates

Novartis’s revenue is mainly driven by the strong performance of its Innovative Medicines business, though Sandoz and Alcon are also significant revenue contributors. Wall Street analysts expect revenue of $12.3 billion in 2Q17, a ~1.6% fall from 2Q16, and earnings per share of $1.19. To divest company-specific risk, investors could consider the Schwab International Equity ETF (SCHF), which has a 0.5% exposure to Novartis, a 0.7% exposure to GlaxoSmithKline (GSK), a 0.6% exposure to AstraZeneca (AZN), and a 0.7% exposure to Sanofi (SNY).