Jefferies Recommends a ‘Buy’ for CLF—What Do Other Analysts Think?

According to the consensus compiled by Thomson Reuters, 22% of the analysts covering Cliffs Natural Resources (CLF) recommended a “sell” for the stock, 33% recommend a “buy,” and 44% recommend a “hold” for the stock.

July 18 2017, Updated 9:07 a.m. ET

Analysts’ recommendations for CLF

According to the consensus compiled by Thomson Reuters, 22% of the analysts covering Cliffs Natural Resources (CLF) recommended a “sell” for the stock, 33% recommend a “buy,” and 44% recommend a “hold” for the stock.

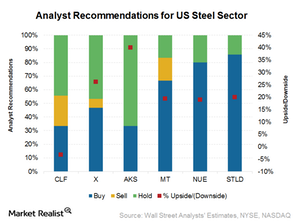

The recent run-up of the stock led the target price to imply a downside of 3.3% compared to its current price. The chart below shows the analysts’ recommendations for Cliffs Natural Resources and its US (SPX) (SPY) steel peers.

Jefferies initiates with a “buy”

On July 7, 2017, Jefferies initiated on Cliffs Natural Resources (CLF) stock with a “buy” recommendation and a target price of $9.00. Jefferies analyst Seth Rosenfeld noted that Cliffs Natural Resources is an “under-recognised beneficiary of US steel market strength.”

Rosenfeld believes that the demand for Cliffs Natural Resources’ iron ore pellets and the average selling prices of its product should benefit from pending trade restrictions through 2018.

Regarding the much-discussed topic of increasing supply growth weighing on seaborne iron ore prices, Rosenfeld added, “CLF’s focus on premium pellets is a defensive positive.”

Other opinions

The analysts at Longbow Research upgraded the US steel sector (SLX), including Steel Dynamics (STLD), U.S. Steel Corporation (X), AK Steel (AKS), and Nucor (NUE), from “neutral” to “buy” in a research note published on June 19, 2017.

The upgrade follows expectations of an improved steel distributor market. The firm expects an uptick of $50–$60 per ton in US HRC (hot rolled coil) prices due to improved downstream steel orders.

In the next part of this series, we’ll take a closer look at Cliffs Natural Resources’ revenue estimates from analysts.