International Monetary Fund Sees Renewed Brexit Pain for the UK

International Monetary Fund slashes UK growth forecast In its World Economic Outlook update, released on July 23, the International Monetary Fund (or IMF) downgraded its growth outlook for the United Kingdom. The IMF said that it expects the UK economy (EWU) to grow at a rate of 1.7% this year, compared with its previous forecast […]

July 31 2017, Updated 9:12 a.m. ET

International Monetary Fund slashes UK growth forecast

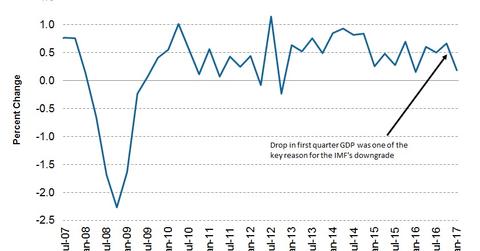

In its World Economic Outlook update, released on July 23, the International Monetary Fund (or IMF) downgraded its growth outlook for the United Kingdom. The IMF said that it expects the UK economy (EWU) to grow at a rate of 1.7% this year, compared with its previous forecast of 2%. The growth projection for 2018 was left unchanged at 1.5%.

Reason for the downgrade

The IMF’s last report was released in April, when the UK seemed resilient after the Brexit referendum in June 2016, in which the majority voted to sever its economic ties with the European Union (VGK). That resilience would have been largely influenced by the weaker British pound (FXB), which resulted in a spike in inflation. Recent economic reports paint a different picture, with the British economy growing just 0.2% in 1Q17, compared with 0.7% in 4Q16.

Brexit uncertainty to keep growth under pressure

The ongoing Brexit negotiations are likely to keep uncertainty in the United Kingdom elevated. Economic and political uncertainty has dented UK consumer confidence (EWUS) and is likely to impact growth. UK businesses (FKU) continue to remain anxious as the outcome of Brexit negotiations could affect them drastically. The Bank of England’s recent bullish outlook could be misleading, as uncertainty may limit growth in the next three or four quarters.