How Hyatt’s Valuation Compares

Current valuation Hyatt (H) currently trades at a forward EV-to-EBITDA multiple of 15.1x. Hyatt’s valuation is significantly higher than its average valuation since January 2010 of 13.0x. Peer comparison Hyatt’s valuation is among the highest in its peer group. Marriott International (MAR) has a multiple of 15.3x, Hilton Worldwide Holdings (HLT) is trading at a […]

July 31 2017, Updated 9:07 a.m. ET

Current valuation

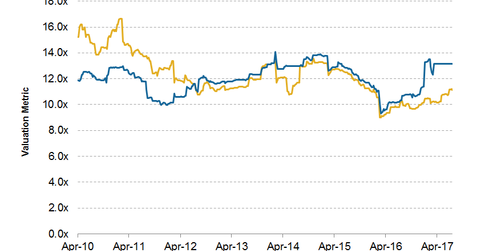

Hyatt (H) currently trades at a forward EV-to-EBITDA multiple of 15.1x. Hyatt’s valuation is significantly higher than its average valuation since January 2010 of 13.0x.

Peer comparison

Hyatt’s valuation is among the highest in its peer group. Marriott International (MAR) has a multiple of 15.3x, Hilton Worldwide Holdings (HLT) is trading at a multiple of 15.1x, Wyndham Worldwide (WYN) is trading at 9.3x, and InterContinental Hotels Group (IHG) is trading at 13.2x.

The market expects Hilton’s EBITDA per share to fall 36.1%. Rival Marriott’s EBITDA per share are expected to grow 40% in 2017, mainly due to Marriott’s December 2016 Starwood acquisition. Hyatt’s EBITDA are expected to grow 4%, InterContinental’s are expected to grow 7%, and Wyndham’s EBITDA are expected to grow 4%.

Our analysis

This year seems to have been good for the hotel sector. The industry began 2017 with strong demand, which has shown in RevPAR (revenue per available room). Consumer confidence, as measured by the University of Michigan, has also been on the rise thanks to falling oil prices, rising employment, and disposable income.

Growing GDP is expected to be yet another positive factor for the hotel sector. However, RevPAR growth is expected to moderate to the average rate of 3.3% seen in the last six years. Expected oversupply in 2017 and beyond could be a major problem for the hotel sector and should be closely monitored by investors. Investors could gain exposure to Hyatt by investing in the First Trust Small Cap Value AlphaDEX ETF (FYT), which invests 0.25% of its portfolio in the company.