What Are Nabors Industries’ Capex Plans for 2017?

Nabors Industries’ (NBR) cash from operating activities (or CFO) turned negative in 1Q17, compared to its positive CFO a year earlier.

June 22 2017, Updated 7:36 a.m. ET

Nabors Industries’ operating cash flows

Nabors Industries’ (NBR) cash from operating activities (or CFO) turned negative in 1Q17, compared to its positive CFO a year earlier. NBR generated -$58 million CFO in 1Q17.

The fall in NBR’s adjusted operating income was the direct result of reduced levels of drilling activity in its International drilling segment. Poor working capital management led to negative CFO for the company in 1Q17.

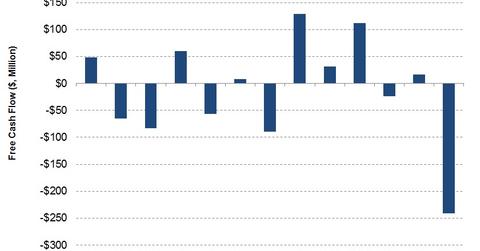

Nabors Industries’ free cash flow

NBR’s capital expenditure (or capex) rose 41% in the year leading up to 1Q17. Its negative CFO coupled with its higher capex led to its FCF deteriorating significantly in 1Q17 compared to 1Q16.

In 1Q17, NBR’s FCF was -$241 million, compared to $32 million a year earlier. In six of the past 13 quarters, Nabors Industries’ FCF was negative.

Peer comparison

Fairmount Santrol Holdings (FMSA) generated FCF of $19 million in 1Q17. Oceaneering International’s (OII) FCF was $26.5 million in the quarter. Oil States International’s (OIS) 1Q17 FCF was $25.7 million.

Nabors Industries makes up 0.15% of the iShares North American Natural Resources ETF (IGE). IGE has fallen 2% in the past year compared to the fall of 19% in NBR’s stock price.

What are Nabors Industries’ capex estimates?

In 2017, NBR expects to spend ~$700 million in capex, 75% higher than its 2016 capex. NBR expects to have a larger fleet of high-specification land rigs in 2017 following its projected higher capex spending in 2017.

Next, we’ll discuss Nabors Industries’ dividends and dividend yields.