Can the S&P 500 Index Keep Rallying amid Slow Job Growth?

SPY recorded yet another lifetime high of 2,440.04 on Friday, June 2, gaining 0.96% for the week and continuing its 1.43% gain from the previous week.

Jun. 5 2017, Updated 6:06 p.m. ET

Poor jobs report fails to cool off US markets

The S&P 500 Index (SPY) recorded yet another lifetime high of 2,440.04 on Friday, June 2, gaining 0.96% for the week and continuing its 1.43% gain from the previous week. What left analysts puzzled was the market reaction after the US non-farm jobs report. The US economy, according to the non-farm payroll data, added 138,000 new jobs in May—nearly 50,000 lower than the market expected.

Economic data seems thus to have taken a back seat, for now, in investors’ minds. Lower crude prices and a reduction in US consumer confidence in May did little to tame investor appetites, and the fuel that appears to keep stoking the fire among markets (QQQ) is likely the hope that President Donald Trump will still be able to push his promised reforms through US Congress.

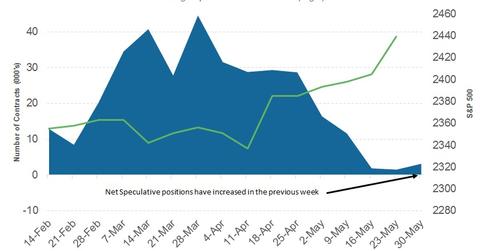

Rising speculator net positions

According to the latest COT (Commitment of Traders) report, speculators and traders have increased the size of their positions from the previous week, in the first increase in net positions on the S&P 500 Index (UPRO) since April 18, 2017. The COT report, which is released every Friday and is updated through Tuesday of the same week, shows how large speculators and traders have positioned themselves in the futures markets.

Total net positions stood at -8,085 contracts, representing a change of -1,499 contracts as compared to the data from the previous week. What we can infer from these large traders and speculator positions in futures markets is that traders are a little nervous as markets enter unchartered territory.

The week ahead

This week (ended June 9), the US economic calendar remains slim, while the earnings calendar has no major market-moving companies. Investors will likely be paying attention to oil prices (UCO), as supply glut concerns are resurfacing and any further decline in oil prices could have an impact on the energy sector (XLE). The UK’s upcoming election and the European Central Bank’s policy decision on June 8 will be key events.

In the next part, we’ll analyze the US dollar’s reaction to the latest US jobs report.