Will the Energy Sector Lag in Summer Months?

2016 proved fruitful for the energy sector (XLE) with an improvement in oil prices (USO) (USL).

May 18 2017, Published 1:08 p.m. ET

Direxion

Energy has lagged and has always felt the heat in summer

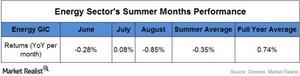

One of the worst-performing sectors since the election has been Energy. But we know that OPEC and supply and demand dynamics have a lot to do with how well Energy does in any timeframe, no matter what election has happened or what season it is. Having said that, energy does tend to lag even more in the summer. Maybe it has something to do with buying up until the driving season starts on Memorial Day and then selling afterward. In fairness, the volatility is not as great, but the gap between the summer month average -0.35% and the full year (0.74%) is more than a full percentage point.[1.Past performance is not indicative of future returns.]

It will be interesting to see if Energy can buck its own poor seasonal track record as well as its recent underperformance.[2.Past performance is not indicative of future returns.]

Market Realist

Energy sector has been the worst performer since the election

2016 proved fruitful for the energy sector (XLE) with an improvement in oil prices (USO) (USL). The sector rose around 25% for the year. However, since the elections, the sector has seen a declining trend owing to negative earnings in some energy stocks. The sector has fallen 2% since elections as of May 8, 2017.

The World Bank’s quarterly report states that an agreement between the OPEC (Organization of the Petroleum Exporting Countries) producers and non-OPEC producers to cap crude-oil output in the first half of 2017 drove the forecast for crude oil prices to $55 per barrel in 2017, an increase of $12 per barrel. Production cuts of crude oil by 1.2 million barrels a day were also announced in November by members of OPEC to boost prices.

Can Trump’s proposed energy policy benefit the sector?

President Trump proposed to lift regulatory restrictions on crude oil and natural gas exploration and production and devote more federal land to crude oil and natural gas drilling. He also supports increasing the production of fossil fuels like coal, crude oil, and natural gas. He also has promised to support the coal industry. These policies could benefit the energy sector in 2017. Also, any unanticipated decisions from OPEC in 2017 could bring a change in crude oil price movement.

The chart of historical data shows that the energy sector underperforms during summer months on average. Having said that, supply and demand seem to be harmonizing with global and US oil demand gaining modest growth. So either way, investors can consider the Direxion Daily Energy Bull (ERX) and the Bear 3X ETF (ERY).