How Does Moat Investing Provide a Competitive Advantage?

Morningstar helps investors choose companies with economic moats. “Economic moats” refers to companies’ ability to obtain an advantage over competitors.

May 31 2017, Published 10:47 a.m. ET

VanEck

Performance Overview

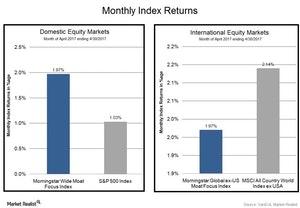

The U.S.-oriented Morningstar® Wide Moat Focus IndexSM (MWMFTR, or “U.S. Moat Index”) posted strong returns in April and outpaced the S&P 500® Index (1.97% vs. 1.03%). The U.S. Moat Index extended its outperformance of the S&P 500 Index to nearly 3.00% for the year-to-date period (10.12% vs. 7.16%). International moat stocks, as represented by the Morningstar® Global ex-US Moat Focus IndexSM(MGEUMFUN, or “International Moat Index”), performed mostly in line with the MSCI All Country World Index ex USA for the month (1.97% vs. 2.14%), but maintained their outperformance gap for YTD 2017 (13.26% vs. 10.17%).

Market Realist

How firms obtain economic moat ratings

Morningstar, with its fundamental approach to investing, helps investors identify and choose companies with economic moats. “Economic moats” is a term coined and popularized by Warren Buffett. It refers to companies’ ability to obtain a competitive advantage over competitors. Morningstar identified two requirements for companies to obtain economic ratings of “narrow” or “wide.” Companies have to earn above-average returns on capital and prevent returns from wearing down quickly.

To obtain a “narrow” or “wide” economic moat rating, firms must hold some competitive advantage over their competitors, which helps them create long-term value for shareholders and higher returns for investors. The above chart shows the five sources of obtaining a competitive advantage or economic moats.

Morningstar moat indices outperformed in April

Since President Trump was elected, the US economy has seen a turnaround. With the improving economy, the S&P 500 Index (SPY) (IVV) has been rising—it has delivered 7.9% year-to-date. According to Factset, S&P 500 companies saw earnings growth of ~14% YoY (year-over-year) in 1Q17—the highest YoY earnings growth for the index since 3Q11. However, the Morningstar Wide Moat Focus Index or the U.S. Moat Index (MOAT) outperformed the S&P 500 Index in April and YTD, as shown in the following charts. The index provides exposure to UD stocks that have a wide moat rating and trade at a discount to Morningstar analysts’ fair value estimates.

On the other hand, the Morningstar Global ex-US Moat Focus Index (MOTI) or the international moat index’s performance in April was almost at par with the MSCI All Country World Index (ACWI) while outperforming on a YTD basis. The index provides exposure to non-US quality stocks in developed and emerging markets with a “wide” or “narrow” moat rating that trade at an attractive price. Moat indices’ outperformance was led by carefully chosen companies with a sustainable competitive advantage.

In the next part, we’ll discuss which companies were the leaders and laggards in the Morningstar moat indices’ performance for April 2017.