MPC, TSO, VLO, PSX: Which Refining Stock Is Trading at a Premium?

Now, let’s look at the forward valuations of Marathon Petroleum (MPC), Tesoro (TSO), Valero Energy (VLO), and Phillips 66 (PSX).

Nov. 20 2020, Updated 5:02 p.m. ET

Average valuation multiples

Earlier, we discussed refining stocks’ 1Q17 performances and dividend yields. Now, let’s look at the forward valuations of Marathon Petroleum (MPC), Tesoro (TSO), Valero Energy (VLO), and Phillips 66 (PSX).

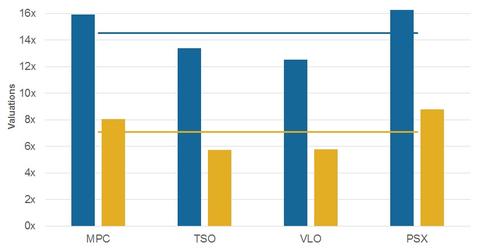

The average forward EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) and average forward price-to-earnings (or PE) of MPC, VLO, TSO, and PSX stand at 7.1x and 14.5x, respectively.

Which refining stocks are trading at premiums?

Phillips 66 is trading at a forward EV-to-EBITDA of 8.8x and a forward PE of 16.3x, above the peer averages. Similarly, Marathon Petroleum’s forward EV-to-EBITDA is 8.1x, and its forward PE is 15.9x. Why are PSX and MPC trading at premiums to the peer averages?

Phillips 66 has a diversified earnings model aimed at shielding itself from the refining environment’s volatility. Plus, the company is focusing on increasing its steady midstream and marketing segment earnings.

Marathon Petroleum is in the midst of implementing a strategic plan that includes dropping down midstream assets to its MLP. For more information, read MPC’s Strategic Plan to Unlock Value: What’s It All About?

PSX’s diversified earnings model and MPC’s strategic initiatives are the likely reasons for their trading at premium valuations.

TSO and VLO’s valuations

Contrarily, Valero Energy and Tesoro are trading lower than the peer averages in both valuation metrics. VLO’s forward PE and forward EV-to-EBITDA stand at 12.5x and 5.8x, respectively, and TSO’s stand at 13.4x and 5.7x, respectively.

Tesoro has been trading at lower multiples likely due to the steep rise in its leverage level due to its ongoing acquisition of Western Refining (WNR). TSO has the highest leverage ratio, its total debt-to-total capital, compared to VLO, MPC, and PSX. For more information, read Leverage of Refiners: Ranking MPC, TSO, VLO, and PSX.

Valero, on the other hand, is suffering due to high compliance costs in the form of its purchase of RINs (renewable identification number), which are denting its refining earnings. VLO spent ~$749 million on the purchase of RINs in 2016. The cost, if estimated as a percentage of its operating margin, stands at 21%. The expense is expected to be at a similar level in 2017. The RIN purchase burden and volatile RIN prices are the likely reasons for VLO’s trading below the peer averages.

For exposure to small-cap stocks, you can consider the iShares Russell 2000 Value ETF (IWN). The ETF has ~6% exposure to energy sector stocks, including WNR.

To know which refining stock has a higher beta, move on to the next article.