What Do Fed Officials Have to Say after the March Meeting Minutes?

Markets will be monitoring any comments from the Fed going forward, and every future meeting will likely be lively in terms of the possibility of another rate hike.

April 10 2017, Published 5:48 p.m. ET

Fed speakers since March meeting minutes release

New York Fed President William C. Dudley, in his remarks at the Princeton Club of New York on April 7, 2017, said that he sees rate hikes as a key policy tool and indicated that balance sheet reduction would be gradual. He also stated that the possibility of the Fed’s balance sheet shrinking to the pre-crisis level remains very low.

Meanwhile, Federal Reserve Governor Daniel Tarullo, in his interview with CNBC on April 5, sided with the view that markets are influenced by the actions taken toward the balance sheet and that such actions can have an impact on the yield curve (SJNK).

Upcoming Fed talks

Fed Chair Janet Yellen is scheduled to speak at the University Of Michigan Ford School of Public Policy on Monday, April 10. She is expected to take part in a question-and-answer session, and there’s a strong possibility that the questions will be related to the balance sheet and the rate hike path of the US Federal Reserve. We can expect some market reaction, especially in the fixed income and foreign exchange space, after her comments.

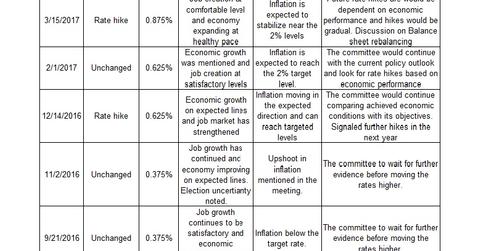

Markets will be monitoring any comments from the Fed going forward, and every meeting, from this point on, will likely be lively in terms of the possibility of another rate hike. But we’ll need to observe all the incoming economic data points and analyze all comments from Fed members for clues as to the timing of the next rate hikes (VRIG)—as well as to also any rebalancing in the Fed’s balance sheet—because the Fed’s actions will certainly have an impact on equity (PDP), fixed income (GSY), and commodity (GLD) markets.

In the next and final part of this series, we’ll focus on the specifics of how such moves could affect different asset classes.