Oil Contango: What It Means for Investors

On April 11, 2017, May 2017 crude oil (DBO) (OIIL) (USL) futures were trading at a discount of $1.15 to May 2018 futures contracts.

Nov. 20 2020, Updated 5:33 p.m. ET

Contango and oil prices

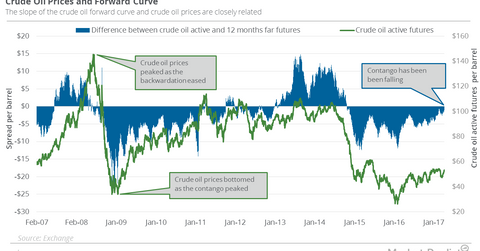

On April 11, 2017, May 2017 crude oil (DBO) (OIIL) (USL) futures were trading at a discount of $1.15 to May 2018 futures contracts. The situation, which is referred to as “contango” in the crude oil futures market, is represented by an upward sloping shape on the futures forward curve.

The structure indicates that there’s market sentiment toward weak crude oil demand right now. Historically, periods of weak crude oil prices coincided with the contango structure. The crude oil forward curve switched to a contango structure in November 2014. Since then, crude oil active futures have fallen ~32.2%.

Backwardation and oil prices

On the other hand, when there’s an immediate demand for crude oil, active crude oil futures trade at higher prices than the futures contracts for the months ahead. It causes the crude oil futures forward curve to slope downward. The situation in the crude oil futures market is referred to as “backwardation.”

Historically, periods of strong crude oil prices coincided with a backwardation structure. Crude oil (SCO) (UCO) (DWTI) active futures closed at a historic high of $145.29 per barrel on July 3, 2008, after an almost one-year period of backwardation in the oil market.

Active crude oil futures traded at a premium of $9.77 to futures contracts 12 months ahead at the peak on November 2, 2007. As the forward curve switched to contango over the course of the following year, with active futures hitting a discount of $24.45 to futures contracts 12 months ahead in January 2009, crude oil prices fell 75.6%.

So, the shape of and the changes in the futures forward curve in the oil market could hint at coming changes in oil prices.

Crude oil forward curve dynamics

After OPEC’s (Organization of the Petroleum Exporting Countries) historic deal in November 2016, the contango structure in the oil market started to flatten. On February 23, 2017, WTI (West Texas Intermediate) crude oil active futures were at their highest levels since July 6, 2015.

But, due to rising US oil production and record oil inventory levels, the spread started to widen on February 23, 2017. Since then, crude oil has fallen 1.9%. In the past week, crude oil prices rose 4.6% as contango fell from $1.68 to $1.15.

The crude oil forward curve’s dynamics can also have implications on oil storage MLPs (AMLP). The dynamics can impact upstream oil producers’ (XOP) hedging decisions. The fall in the contango spread could point to fewer concerns about crude oil’s demand-supply imbalance. It could mean that the market sees higher prices coming in the spot crude oil market.

The curve’s dynamics also have important implications for the performance of commodity-tracking ETFs such as the United States Oil ETF (USO). Due to the contango structure in the oil market, USO underperformed crude oil prices. However, that could change if the oil market switches to backwardation.