Newmont Mining: How’s the Project Pipeline Looking?

Newmont Mining (NEM) approved funding for its Northwest Exodus project in June 2016, and the project is now under construction.

Feb. 27 2017, Updated 9:08 a.m. ET

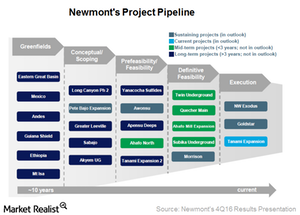

Project pipeline

Newmont Mining (NEM) has four projects in their final stages, all of which should start production in 2017 or 2018. Two of its critical projects came online in 2016, and both projects were ahead of schedule and under budget.

Newmont Mining’s project pipeline is one of the strongest among its peers, including Barrick Gold (ABX), Kinross Gold (KGC), and AngloGold Ashanti (AU). AngloGold Ashanti and Kinross Gold make up 3.7% and 2.8%, respectively, of the VanEck Vectors Gold Miners ETF (GDX).

Projects included in this outlook

As shown in the above chart, Newmont Mining (NEM) has included its current projects and sustaining capital projects in its outlook. These projects include the Tanami Expansion and Morrison mine in Australia, as well as Northwest Exodus and Goldstar in Nevada.

Newmont Mining approved funding for its Northwest Exodus project in June 2016, and the project is now under construction. According to the company, this project is a profitable expansion located near its existing underground mine in the Carlin North area. It plans to use the existing infrastructure at the site to add low-cost ounces to the company’s portfolio.

The Tanami Expansion in Australia is also on budget and on schedule. It’s expected to start production by the second half of 2017. It’s expected to increase production and lower all-in sustaining costs at the existing Tanami operation.

Newmont Mining expects to generate an internal rate of return in the mid-30% range on this project. The company noted during its earnings call that the recent exploration results at Tanami have confirmed the potential to double the current reserve base.

The Goldstar mine is expected to deliver over 500,000 ounces of production over a 13-year period.

NEM’s medium-term and long-term projects

The five projects highlighted in green in the above chart represent projects that Newmont Mining expects to improve its medium-term production and cost profile. The company expects to approve four out of these five projects during 2017. The projects highlighted in dark blue are the company’s longer-term projects.

Newmont Mining’s project pipeline is one of the strongest among its peers, including Barrick Gold (ABX) and Agnico Eagle Mines (AEM). Although Kinross Gold (KGC) has approved its Tasiast Phase 1 expansion, there could still be concerns regarding its long-term production growth. Kinross Gold comprises 2.8% of the VanEck Vectors Gold Miners ETF (GDX).