Hanesbrands Stock Reacts to Weak Results and Gloomy Guidance

Shares of Hanesbrands (HBI) tumbled 16% on Friday, February 3, as the company posted weaker-than-expected fourth quarter results and lackluster guidance.

Feb. 7 2017, Updated 9:07 a.m. ET

HBI’s stock falls 16% after fourth-quarter results

Shares of Hanesbrands (HBI) tumbled 16% on Friday, February 3, as the company posted weaker-than-expected fourth quarter results and lackluster guidance. The company’s stock price touched a three-year low, closing at $18.98 on Friday.

HBI now trades 60% below its 52-week high price and is down 12% year-to-date (or YTD). The company lost 27% of its value in 2016.

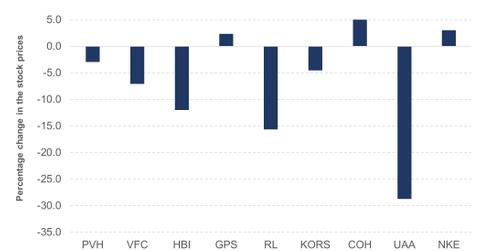

Many of HBI’s apparel sector peers finished 2016 in red and had continued the trend in 2017. VF Corp (VFC), Michael Kors (KORS), and Ralph Lauren (RL) are down 7%, 5%, and 15.7% YTD.

The S&P 500 Apparel and Accessories Index—which is a seven-company index based on Ralph Lauren, Hanesbrands, VF Corp, Coach (COH), PVH Corp (PVH), Michael Kors, and Under Armour (UA)—is down 9% YTD.

Wall Street, however, expects the stock to bounce back this year. Read the next part of this series to learn about the analyst view of the company.

Dividends and buybacks

HBI is a regular dividend-paying company. It recently increased its dividend per share by 36% to 15 cents a share. The company paid $550 million to its shareholders through dividends and share buybacks in fiscal 2016.

“Despite the challenging environment, we were able to manage inventory and generate cash, returning nearly $550 million to shareholders through quarterly cash dividends and share repurchases,” commented Hanes CEO Gerald W. Evans Jr.

The company’s stock offers a dividend yield of 3%, in line with the yields offered by other apparel players. Ralph Lauren, VF Corp, and Gap have dividend yields of 2.8%, 3.3%, and 4.1%, respectively.

Investors wanting to get exposure to HBI can consider pooled investment vehicles like the Guggenheim S&P 500 Equal Weight Consumer Discretionary ETF (RCD), which invests 1.09% of its portfolio in HBI.