Investing in Environmental, Social, and Governance ETFs

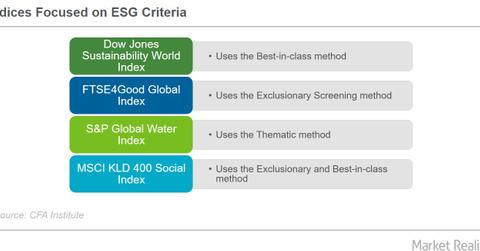

Some stock indexes have taken into consideration ESG (environmental, social, and governance) criteria, applying the methods outlined in the previous article to tackle ESG issues.

Nov. 1 2016, Updated 6:04 p.m. ET

Indexes based on methods that consider ESG criteria

Some stock indexes have taken into consideration ESG (environmental, social, and governance) criteria, applying the methods outlined in the previous article to tackle ESG issues.

The graph above has been prepared from information taken from the CFA Institute.

Funds that can help you to invest socially responsibly

Companies such as Calvert Investments and Pax World Investments have been managing funds using ESG criteria for a while. This arena includes Appleseed, Domini, Thornburg Investment Management, and TIAA, among several others. Bigwigs such as Goldman Sachs (GS) and BlackRock (BLK) have also entered the arena. Meanwhile, MSCI (MSCI) has several indexes available in the ESG space.

ETFs

The iShares MSCI USA ESG Select ETF (KLD) provides exposure to socially responsible US companies, excluding tobacco companies. The underlying benchmark of the ETF is the MSCI USA ESG Select Index, whose expense ratio is 0.5%.

The iShares MSCI KLD 400 Social ETF (DSI) provides exposure to socially responsible US companies. The underlying benchmark of the ETF is the MSCI KLD 400 Social Index, whose expense ratio is 0.5%.

The VanEck Vectors Global Alternative Energy ETF (GEX) tracks the Ardour Global Index (Extra Liquid), which tracks the overall performances of companies involved in the alternative energy business. Its expense ratio is 0.62%.

The Workplace Equality Portfolio ETF (EQLT) tracks the Workplace Equality Index. The fund manager’s website states that the index “includes many of America’s leading equality-minded corporations. It consists of publicly-traded companies that support lesbian, gay, bisexual and transgender (or LGBT) equality in the workplace.” Its expense ratio is 0.75%.

The PowerShares Water Resources ETF (PHO) tracks the NASDAQ OMX US Water Index. According to the fund’s website, the index comprises stocks of companies “that create products designed to conserve and purify water for homes, businesses and industries.” Its expense ratio is 0.61%.

The list above is only indicative and intends to give us an idea of the diverse investment themes that are provided under the ESG investment umbrella via ETFs.

Some ETFs have integrated ESG into their investment choices. The names of ETFs such as the Vident International Equity ETF (VIDI) and the SPDR Nuveen Barclays Short Term Municipal Bond ETF (SHM) don’t suggest that they’re anything like the above-mentioned funds, but they integrate ESG criteria into their research process when investing.

In the next article, let’s look at some mutual funds that invest based on ESG criteria.