What Are Institutional Investors Doing with American Water Works Holdings?

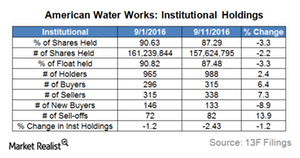

Institutional investors have decreased their positions in American Water Works (AWK) in the past couple of months.

Nov. 18 2016, Updated 8:04 a.m. ET

Institutional investor sentiment

Institutional investors have decreased their positions in American Water Works (AWK) in the past couple of months. The percentage of float held in AWK by institutional investors has fallen by more than 3% as of November 9, 2016, as compared to September 1, 2016. (“Float” refers to the number of a company’s shares that are available for trading.)

American Water Works’ float

For AWK, the number of buyers has risen more than 6%, and the number of sellers has risen 7%. But the number of new buyers fell 9%, while the number of sell-offs rose 14%.

The percentage of float held by institutional investors in AWK fell from 90.6% at the end of August 2016 to 87.4% on November 9, 2016. Notably, BlackRock, Vanguard, and State Street are the top three institutions holding American Water Works.

It will be interesting to see the movement of water utility stocks going forward because the sentiment of institutional investors toward water utilities (PIO) seems mixed. Fair yields and stable earnings growth appear to be keeping investors in safe-haven water utilities (CGW).

Shares of water utilities in the second half of 2016 fell mostly on valuation concerns and the rising possibility of an interest rate hike. The stock’s appreciation, which formed the major part of water utilities’ total returns in the past year, thus seems precarious.