Are US Water Utilities Fairly Valued?

It seems that US water utilities are trading at a premium compared electric utilities.

July 11 2016, Updated 9:06 a.m. ET

Valuation

It seems that US water utilities are trading at a premium compared to electric utilities. Both witnessed a solid rally in 2016 and touched record high valuations. Thus, fear of correction looms over utilities in the near future. Poor results in the second quarter or unfavorable interest rate developments could hurt their valuations.

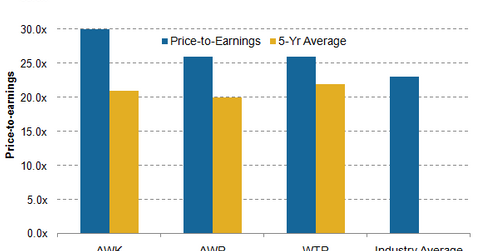

Water utilities are at towering valuations

As of July 5, 2016, American Water Works (AWK) is trading at a price-to-earnings ratio of 30x. Its five-year historical average price-to-earnings ratio stands at 21x. It’s also overvalued compared to the industry average of 23x.

Peers American States Water (AWR) and Aqua America (WTR) are also trading at a heavy premium compared to their historical average price-to-earnings and sector average.

Water utilities’ EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) ratios are also reaching new highs. American Water Works’ EV-to-EBITDA ratio is near 14x while the industry average comes around 12x. American States Water and Aqua America have ratios 12.5x and 18x, respectively. These utilities are also trading at a premium compared to their historical averages.

The EV-to-EBITDA ratio measures whether the stock is overvalued or undervalued, regardless of the company’s capital structure.

Investors may remain invested in power utilities longer than water utilities, as electric utilities are trading at much higher yields. Electric utilities (XLU) are providing protection during the turbulent times as well as offering handsome returns. Also, water utilities (PIO) are trading at much higher valuations, which indicates the possibility that a correction will happen sooner and faster for water utilities compared to electric utilities.