Why Susquehanna Downgraded Deckers Outdoor to ‘Negative’

Deckers Outdoor (DECK) has a market cap of $1.8 billion. It fell 6.7% to close at $56.92 per share on October 13, 2016.

Oct. 14 2016, Published 12:26 p.m. ET

Price movement

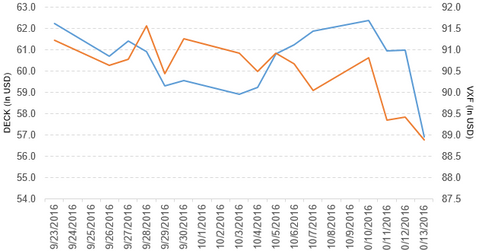

Deckers Outdoor (DECK) has a market cap of $1.8 billion. It fell 6.7% to close at $56.92 per share on October 13, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -7.1%, -1.6%, and 20.6%, respectively, on the same day.

DECK is trading 6.7% below its 20-day moving average, 9.8% below its 50-day moving average, and 0.19% above its 200-day moving average.

Related ETF and peers

The Vanguard Extended Market ETF (VXF) invests 0.05% of its holdings in Deckers Outdoor. It tracks a market-cap-weighted version of the S&P Total Market Index, excluding all S&P 500 stocks. The YTD price movement of VXF was 7.1% on October 13.

The market caps of Deckers Outdoor’s competitors are as follows:

Deckers Outdoor’s rating

Susquehanna has downgraded Deckers Outdoor’s rating to “negative” from “neutral.” It also reduced the stock’s price target to $49 from $59 per share.

TheStreet reported, “The company’s UGG shoe brand is ‘clearly at risk’ since it already has started to run promotions, the firm claimed, Barron’s reports.” It added, “Ugg.com has begun to offer $20 rewards certificates for members of its loyalty program, Susquehanna explained.”

Performance of Deckers Outdoor in fiscal 1Q17

Deckers Outdoor reported fiscal 1Q17 net sales of $174.4 million, a fall of 18.4% compared to $213.8 million in fiscal 1Q16. The company’s gross profit margin rose 8.0% in fiscal 1Q17 compared to the prior year’s period.

Its net income and EPS (earnings per share) fell to -$58.9 million and -$1.84, respectively, in fiscal 1Q17 compared to -$47.3 million and -$1.43, respectively, in fiscal 1Q16.

DECK’s cash and cash equivalents fell 17.8%, and its inventories rose 56.5% in fiscal 1Q17 compared to fiscal 4Q16. Its current ratio fell to 2.3x, and its debt-to-equity ratio rose to 0.48x in fiscal 1Q17 compared to 3.3x and 0.32, respectively, in fiscal 4Q16.

Projections

Deckers Outdoor has made the following projections for fiscal 2017:

- rise in net sales of -3% to flat

- gross margin of 47.0%–47.5%

- EPS of $4.05–$4.40, which excludes any pretax charges from restructuring charges of $10 million–$15 million

The company has made the following projections for fiscal 2Q17:

- rise in net sales of 1%–3%

- EPS of $1.12–$1.22

Now we’ll have a look at Kellogg (K).