JNJ Moved to Restructure Its Medical Devices Business in 3Q16

Johnson & Johnson (JNJ) registered sales of ~$6.2 billion in its Medical Devices segment in 2Q16. The Vision Care business reported the highest growth in the quarter, which came in at ~8.2%.

Oct. 21 2016, Updated 6:04 p.m. ET

Overview

Johnson & Johnson (JNJ) registered sales of approximately $6.2 billion in its Medical Devices segment in 2Q16. The Orthopedics and Surgical segments were the major sales contributors, comprising ~36.5% and 37.1%, respectively, of the segment’s total revenues. However, the Vision Care business reported the highest growth in the quarter of ~8.2%.

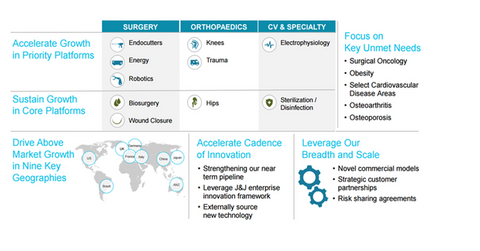

Johnson & Johnson (JNJ) focuses on its Medical Devices business restructuring to attain a profitable and efficient business structure. The above diagram shows the key growth strategies that are driving these restructuring efforts, which are expected to yield around $800 million–$1 billion in annual savings. The majority of these savings are expected to be realized by the end of 2018.

Over the last few quarters, Johnson & Johnson expects to witness a marked above-market performance growth in its Medical Device business. The company is keen on making bolt-on acquisitions and expanding into attractive markets for the segment’s growth.

Johnson & Johnson believes that the cardiovascular space is a potential growth area in businesses such as the Structural Heart business. The company already has a strong presence in the Electrophysiology business in the cardiovascular market.

Abbott Medical Optics acquisition

As part of its restructuring efforts, on September 16, 2016, the company announced the acquisition of Abbott Medical Optics for ~$4.3 billion in cash. The acquisition is expected to close by the first quarter of 2017 and is expected to be immediately accretive to earnings.

The acquisition will further accelerate the company’s Vision Care business, which has seen strong growth. For the deal rationale, please read The Rationale behind Johnson & Johnson’s Acquisition of Abbott Medical Optics.

Acclarent Aera launch

On September 19, 2016, Johnson & Johnson (JNJ) announced the launch of the first balloon dilation intervention system for ETD (eustachian tube dysfunction) approved by the FDA. For more on these product details, please read Inside Johnson & Johnson’s Latest US Medical Device Launch.

Johnson & Johnson’s major medical device competitors include Medtronic (MDT), Stryker (SYK), and Abbott Laboratories (ABT), which have also been actively pursuing growth strategies such as strategic acquisitions and new product launches. The SPDR Dow Jones Industrial Average ETF (DIA) invests ~4.3% of its total holdings in JNJ stock.

In the next article in this series, we’ll discuss JNJ’s recent stock performance.