Coca-Cola’s Growth Strategy for Soda and Still Beverages

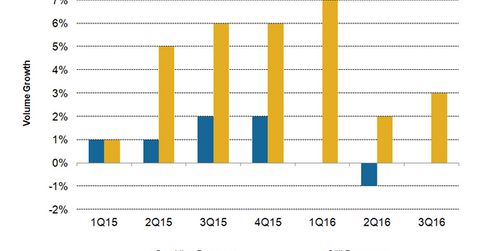

Coca-Cola’s (KO) overall unit case volume rose 1% in 3Q16. The company’s soda or sparkling beverage unit case volumes were flat in 3Q16 on a YoY basis.

Nov. 20 2020, Updated 4:08 p.m. ET

Soda beverages disappoint

The Coca-Cola Company’s (KO) overall unit case volume rose 1% in 3Q16. The company’s soda or sparkling beverage unit case volumes were flat in 3Q16 on a YoY (year-over-year) basis. Higher soda volumes in three operating segments (Europe, the Middle East and Africa, North America as well as Asia-Pacific) were offset by a 2% fall in Latin America soda volumes.

Strength in still beverages

Coca-Cola’s still beverages continued to outperform soda beverages in terms of volume growth. In 3Q16, the unit case volume of Coca-Cola’s still beverages rose 3% mainly on higher bottled water and sports drinks volumes.

PepsiCo’s (PEP) carbonated soft drink volumes declined by 3%, while noncarbonated beverage volumes rose 7% in 3Q16. Dr Pepper Snapple (DPS) reported a 2% rise in the 3Q16 carbonated soft drink volumes while noncarbonated beverages volumes were flat YoY.

Growth Strategy

In the 3Q16 conference call, Coca-Cola’s Chief Operating Officer James Quincey elaborately discussed the growth strategies for both the sparkling and still beverage categories.

In the sparkling category, the company is working on more sugar-free options and is also focusing on smaller packages. Coca-Cola’s COO also mentioned that the company is working on over 200 reformulation initiatives to reduce added sugar in its beverages.

Coca-Cola is aggressively expanding its still beverage portfolio to meet the growing consumer needs for healthier beverage options. The company is expanding its still beverage portfolio through internal innovation and bolt-on acquisitions. In September 2016, Coca-Cola’s announced that it will launch ready-to-drink tea lattes and coffees under the Gold Peak brand in 1Q17. Gold Peak is a popular brand iced tea brand. In September 2016, the company entered into a deal with Dunkin’ Donuts, part of Dunkin’ Brands (DNKN), to launch ready-to-drink coffee beverages in early 2017.

Currently, 14 out of Coca-Cola’s 20-billion-dollar brands (each generating over $1 billion in retail sales annually) belong to the still beverage space. In the 3Q16 conference call, Coca-Cola’s COO mentioned that the company has sold 5.8 billion incremental servings of its still beverage brands and has captured over 25% of the value growth globally in the stills category year-to-date.

We’ll discuss the company’s segment performance in the next part of this series.