Will China’s Economic Transition Benefit the Country?

Small and medium enterprises (SMEs) remain at the center of the narrative as China transitions from an “old” production-driven model to the “new” consumer and service-led economy.

Oct. 11 2016, Updated 8:04 a.m. ET

China’s new economy transition

Small and medium enterprises (SMEs) remain at the center of the narrative as China transitions from an “old” production-driven model to the “new” consumer and service-led economy. In this context, we believe VanEck Vectors™ ChinaAMC SME-ChiNext ETF (NYSE Arca: CNXT) provides not only exposure primarily to China’s market for innovative, non-government owned companies, but also to the very sectors that are increasingly recognized as underpinning the growth of the country’s “New Economy.” CNXT gives investors a liquid, transparent way to gain access to some of these growing companies.

Market Realist – Diversified exposure

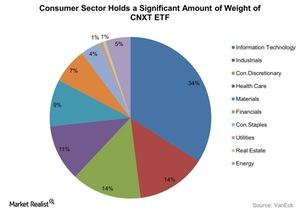

Investing in emerging market economies (EEM) gives investors diversified exposure. As stated above, the VanEck Vectors™ ChinaAMC SME-ChiNext ETF (CNXT) can give investors exposure to growing companies in China (FXI)(MCHI). The chart above shows the ETF’s sector weight. This ETF has around an 18% combined weight in the consumer discretionary and consumer staples sector, the significant segment of China’s new economy. Since its inception, this ETF has returned 15%.

The country is shifting its focus from export-driven, low-cost manufacturing to consumer-led growth. After the global financial crisis of 2008–2009, the country’s manufacturing sector has been suffering. However, the drift into the new economy of consumer services can help revive the economy. McKinsey’s “China Consumer Report” stated that consumer spending in China is transitioning from products to services and from mass to premium segments, supporting the new economy.

Market Realist – Inflation to support the new economy

China’s inflation rate rose 1.3% year-over-year in August 2016. It rose 1.8% in July. The inflation rate lies significantly below its official consumer inflation target of 3.0%. However, the country is confident about reaching its target, as reported by its top economic planner in August. Moderate inflation helps the economy since increased consumer prices help market demand for goods and services improve further. This effect calls for more consumer spending as people start buying more with the expectation of higher prices. At present, inflation is benefiting China’s plan for a consumption-led economy.

Mark Mobius, the executive chairman of Franklin Templeton Emerging Markets Group, is optimistic about the transition of China’s economy. He believes that, over five to six years, this new economy could grow.