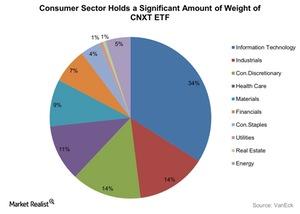

VanEck Vectors ChinaAMC SME-ChiNext ETF

Latest VanEck Vectors ChinaAMC SME-ChiNext ETF News and Updates

Will China’s Economic Transition Benefit the Country?

Small and medium enterprises (SMEs) remain at the center of the narrative as China transitions from an “old” production-driven model to the “new” consumer and service-led economy.

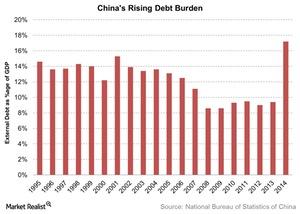

Where Does China’s Debt Risk Burden Lie?

Since the global financial crisis in 2008, China’s debt concern has increased. China (FXI) (CNXT) landed itself in massive debt to revive its economy.

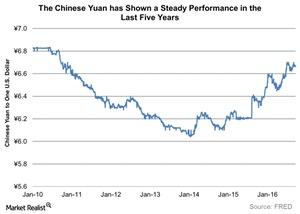

Is China Still Concerned about Capital Outflows?

We continue to believe that when evaluating any investment in either the emerging markets or any global allocation of assets, China needs to be considered.

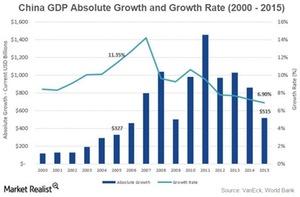

Where Does China’s Economic Growth Stand?

While China may not be posting the double-digit growth numbers of a decade ago, we believe the country continues to offer interesting investment opportunities.